Cannabidiol (CBD) products have sparked a lot of curiosity and discussion in India, especially in recent years.

Cannabidiol (CBD) products have sparked a lot of curiosity and discussion in India, especially in recent years.

From CBD oils to creams, capsules, and even gummies, it seems like there’s a product for everyone seeking stress relief, pain management, or a better night’s sleep.

These products, derived from the cannabis plant, promise a natural alternative for those looking to manage conditions like chronic pain, anxiety, and insomnia without the psychoactive effects commonly associated with marijuana.

However, while CBD’s popularity continues to grow, it still faces significant hurdles, such as premium pricing and social stigma, that may hinder its full mainstream acceptance in India.

CBD, short for cannabidiol, is one of the many compounds found in the cannabis plant, but unlike its more famous cousin, THC (tetrahydrocannabinol)

CBD does not produce a “high.” Instead, it has gained widespread recognition for its potential therapeutic benefits, such as easing anxiety, chronic pain, and inflammation.

The medical and wellness community has increasingly embraced CBD for its versatility, and research into its effects continues to grow globally.

The use of CBD in India can be traced back to the country’s historical relationship with hemp and cannabis.

Hemp, a variety of cannabis with low THC levels, has been used in India for centuries in textiles, medicines, and even as a recreational beverage (bhang).

However, the modern adoption of CBD is relatively new, largely influenced by Western markets, where CBD products began to see mass adoption in the early 2010s.

India, with its growing interest in holistic and alternative medicine, has gradually warmed up to the idea of CBD.

The legal framework began to take shape in 2018 when Uttarakhand became the first state to legalize industrial hemp farming.

Over the following years, more states, including Madhya Pradesh and Himachal Pradesh, followed suit. By 2021, the sale of CBD-based products was regulated by the Food Safety and Standards Authority of India (FSSAI), giving a more structured path for CBD businesses to grow.

What started as a niche wellness trend among the urban elite in cities like Mumbai and Bengaluru has now slowly trickled down to smaller cities and even rural areas, where hemp farming and CBD oil production are gaining ground.

Yet, despite this increasing awareness, CBD products still face an uphill battle in terms of stigma, pricing, and limited research on long-term effects.

The market for CBD products in India is steadily growing, despite being in its nascent stages.

As of 2022, the Indian CBD oil market was valued at approximately USD 264.5 million, with projections suggesting that it will continue to grow at a robust pace over the coming years.

By 2033, the market is expected to reach a value of around USD 2.4 billion, driven by a 14.8% CAGR.

This growth is indicative of a larger global trend where consumers are increasingly seeking natural wellness products, and India is no exception.

The market is witnessing significant traction, particularly in the wellness sector. The Indian wellness market is projected to grow from USD 156 billion in 2024 to USD 256.9 billion by 2033, with a compound annual growth rate (CAGR) of 5.3% during 2025-2033.

Consumers are becoming more inclined towards plant-based, alternative remedies for conditions like stress, chronic pain, and sleep issues—issues that CBD is often touted to help with.

As these therapeutic benefits become more well-known, demand for CBD products is expected to grow, albeit with hiccups.

The nutraceuticals market in India is experiencing significant growth, with CBD-infused products playing a pivotal role in this expansion.

In 2024, the CBD nutraceuticals sector in India generated a revenue of USD 375.2 million and is projected to reach USD 996.3 million by 2030, reflecting a compound annual growth rate (CAGR) of 15.9% from 2025 to 2030.

This surge is driven by increasing consumer awareness of the potential health benefits of CBD, including its anti-inflammatory and anxiety-relief properties.

The global CBD nutraceuticals market was valued at USD 10.46 billion in 2024 and is projected to grow at a CAGR of 12.6% from 2025 to 2030.

In India, CBD tinctures have emerged as the leading product segment, accounting for the largest revenue share in 2024.

Additionally, capsules and softgels are anticipated to be the fastest-growing segments during the forecast period, owing to their convenience and precise dosing.

The expansion of the CBD nutraceuticals market is further supported by the global trend towards plant-based supplements and the increasing legalization of hemp-derived products.

As regulatory frameworks become more accommodating and consumer interest in natural health solutions rises, the CBD nutraceuticals sector in India is poised for substantial growth in the coming years.

The rise of CBD products in India is influenced by a blend of social, cultural, economic, and legal factors.

As CBD becomes more mainstream, several elements drive its increasing popularity across the country.

These factors are both direct and indirect contributors to the expanding market and consumer adoption of CBD products.

India’s shift towards health-consciousness, especially among the younger population, has played a crucial role in the adoption of CBD products.

Reports suggest that millennials, who have a higher disposable income and a greater interest in holistic health, are among the primary adopters of CBD products.

A survey by Market Research Future in 2021 found that wellness trends were increasingly driven by this demographic, who prioritize natural products for pain relief, sleep disorders, and stress.

The growing awareness of CBD’s therapeutic potential—ranging from alleviating chronic pain to managing anxiety—has sparked its rise in Indian households.

Mental health has increasingly become a focus of national discourse in India. As mental health issues like anxiety, depression, and stress gain widespread attention, consumers are increasingly turning to alternative therapies like CBD.

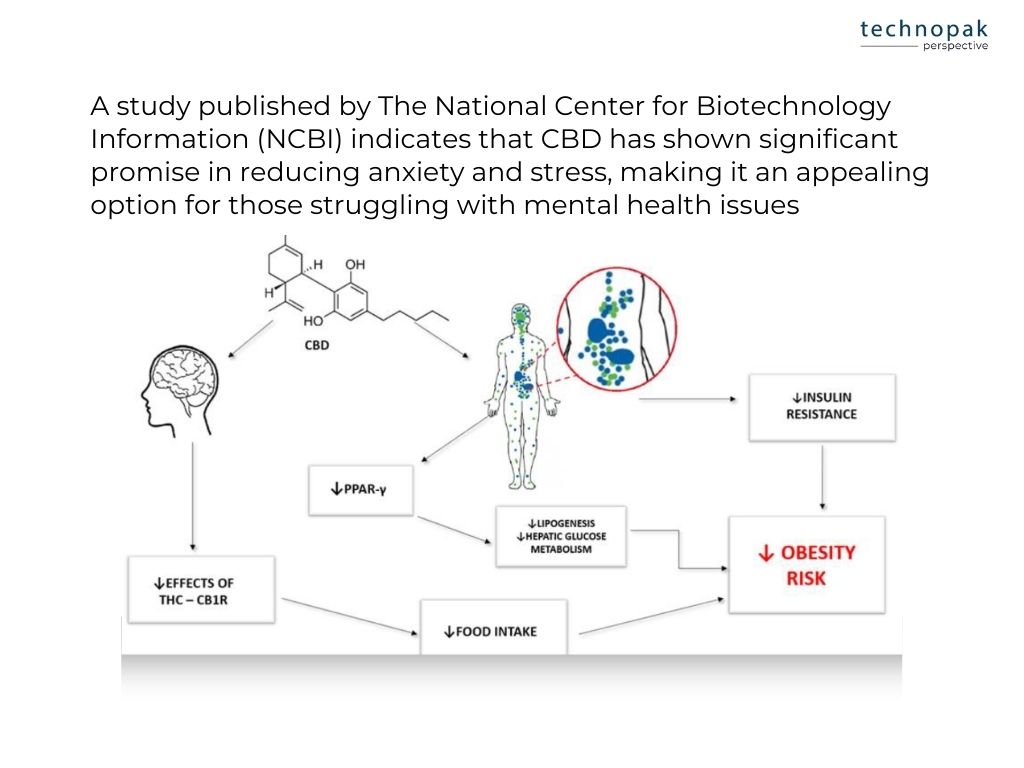

A study published by The National Center for Biotechnology Information (NCBI) indicates that CBD has shown significant promise in reducing anxiety and stress, making it an appealing option for those struggling with mental health issues.

According to Statista, the Indian mental health market is projected to grow at a rate of over 8% CAGR, driving the demand for alternative wellness products such as CBD.

As more people seek alternatives to pharmaceutical medications, CBD products that promise a natural remedy without the side effects of conventional drugs are becoming popular.

Additionally, with initiatives like The National Mental Health Survey of India showing a significant increase in mental health conditions over the past decade, demand for effective and alternative solutions like CBD has risen in parallel.

The power of social media influencers cannot be understated in the rise of CBD products. Instagram and YouTube have become platforms where wellness influencers and celebrities promote alternative health products, including CBD.

For example, influencers like Shweta Mehta and Ranveer Allahbadia have used their platforms to discuss the benefits of CBD for stress relief, sleep improvement, and fitness.

With a combined following of millions, these influencers have introduced their audiences to the holistic potential of CBD products.

A survey by Zefmo indicated that 78% of consumers are influenced by social media posts when making wellness product purchases, and influencers play a critical role in shaping public opinion, particularly among India’s youth. The mainstreaming of CBD through influencers helps reduce the stigma associated with cannabis-derived products and fosters greater consumer confidence.

As more people seek natural solutions for their health problems, CBD fits into this trend perfectly. With the shift towards organic products and natural remedies, consumers in India are increasingly choosing CBD as a safer, plant-based alternative to synthetic drugs.

According to a Grand View Research report, the global CBD market is expected to reach $56.7 billion by 2027, with natural and organic products being a major growth driver.

This growing preference for clean, sustainable products is visible in India as well, where CBD products, especially those that are organically sourced and free from additives, are gaining a competitive edge in the market.

As India’s CBD and hemp industry evolves, innovation in product formats is rapidly reshaping how consumers experience cannabis wellness.

While oils and tinctures remain staples, a new generation of products—ranging from cosmetics and edibles to pet wellness and protein powders—is gaining traction among health-conscious and curious consumers.

Here’s a closer look at the emerging formats redefining the CBD landscape in India.

Transdermal CBD patches are emerging as a convenient, long-lasting solution for pain and anxiety relief. These skin-adhesive patches gradually release CBD into the bloodstream, offering targeted therapeutic effects over several hours.

Brands to Explore

The Indian beauty sector is embracing CBD for its anti-inflammatory, hydrating, and calming properties. Products range from face serums and balms to haircare and lip care, often infused with hemp seed oil or full-spectrum extracts.

Noteworthy Brands

Note: Due to FSSAI regulations, most cosmetics use hemp seed derivatives and avoid THC or explicit CBD health claims.

Though still in its infancy in India, the concept of CBD-infused drinks is beginning to gain visibility. These beverages tap into traditional cannabis culture—think bhang—but with a wellness-oriented twist.

Available Formats

CBD gummies and chocolates are becoming popular for their ease of use, precise dosing, and enjoyable flavours. These edibles are typically sold online and cater to urban consumers seeking a discreet, lifestyle-integrated way to consume CBD.

Top Picks

Note: Look for THC content under 0.3% and clear labelling to ensure legal compliance.

Pet parents in India are exploring CBD to manage issues like anxiety, inflammation, and general wellbeing in dogs and cats. The pet CBD space is growing rapidly, though still awaiting clearer regulatory frameworks.

Leading Pet Brands

Hemp protein is emerging as a clean, plant-based supplement ideal for vegetarians, vegans, and athletes alike. Derived from hemp seeds, it’s a complete protein source, rich in essential amino acids, omega fatty acids, and dietary fibre.

Popular Indian Brands

Great for smoothies, baking, or daily protein shakes—hemp protein is versatile, allergen-friendly, and gut-supportive.

One of the major challenges facing CBD products in India is premium pricing.

Many of the leading brands in the market, such as BOHECO (Bombay Hemp Company), Qurist, and The Hemp Company, emphasize the quality of their products, which is reflected in their pricing.

While this focus on quality is essential for maintaining consumer trust, it also means that CBD products are often more expensive than traditional wellness supplements or over-the-counter medications.

The high cost can make it difficult for many consumers to try CBD products regularly.

This pricing challenge is exacerbated by the fact that the benefits of CBD, although promising, are still not universally accepted, leading some consumers to hesitate before committing to the expense.

Despite the growing awareness about the benefits of CBD, social stigma remains a significant hurdle.

Many people still associate cannabis-based products with recreational drug use due to a lack of understanding of the difference between CBD and THC (tetrahydrocannabinol), the psychoactive compound in marijuana.

While the stigma around cannabis-based products is gradually decreasing, particularly in urban areas, it still lingers in many parts of India, particularly in rural regions.

Yash Kotak, co-founder and chief marketing officer of BOHECO, notes that in 2013, when his company was founded, there was minimal awareness, and cannabis-based products were highly stigmatized.

However, today, growing consumer education, aided by social media and influencers, is changing perceptions.

Despite this progress, a significant gap still exists in understanding CBD’s benefits, leading to hesitation among potential users who may fear that using CBD could have adverse effects or might even be illegal.

Several Indian companies have recognized the potential of CBD and are making strides in offering high-quality products to meet the rising demand for natural wellness solutions:

BOHECO (Bombay Hemp Company)

Established in 2013, BOHECO is a pioneer in India’s hemp industry. The company offers a diverse range of hemp-based products, including hemp seed oil, hemp hearts, and hemp protein powder. BOHECO emphasizes sustainable agriculture and aims to reimagine Indian agriculture by integrating hemp cultivation. They also provide free consultations with Ayurvedic doctors to guide consumers on the therapeutic benefits of hemp-based remedies.

Qurist

Qurist specializes in full-spectrum CBD+THC oils, crafted to support overall wellness. Their products are designed to provide relief from severe pain, promote deep sleep, and enhance mood naturally. Qurist offers oils in varying strengths to cater to individual needs, ensuring quality and efficacy in their formulations.

Health Horizons

Health Horizons is dedicated to bringing natural Sativa (hemp) products to the Indian market. Their product line includes hemp seed oil, hemp protein powder, and hemp hearts. They focus on educating consumers about the potential benefits of hemp while ensuring strict quality control measures.

Awshad

Awshad is a notable CBD brand in India, offering a range of full-spectrum CBD oils in flavors such as Tulsi, Peppermint, and Natural. Their products are licensed under the Ministry of Ayush, Government of India, ensuring adherence to national standards. Awshad emphasizes the combination of cannabis’ healing properties with botanical extracts and rigorous lab research to produce high-quality CBD oil products tailored for the Indian consumer.

Magiccann

Magiccann aims to bring a touch of “magic” to medical cannabis healthcare routines. They offer premium medical cannabis tinctures and extracts, including full-spectrum cannabis extract paste and broad-spectrum CBD oil with zero THC. Their products are designed to cater to various healthcare needs, emphasizing purity and effectiveness.

Cannabryl

Cannabryl is recognized for its range of full-spectrum Vijaya (cannabis) extract products. They offer dewaxed cannabis tinctures with varying CBD to THC ratios, catering to different therapeutic requirements. Their products are crafted to maintain the natural balance of cannabinoids, ensuring a holistic approach to wellness.

Twiee

Twiee offers CBD-infused products that aim to reconnect and reflect one’s inner self. Their product line includes cannabis tinctures designed for mental and physical wellness. Twiee focuses on creating products that promote overall well-being, combining the therapeutic properties of CBD with other beneficial ingredients.

Cannarma

Cannarma specializes in CBD oils, tinctures, and capsules, ensuring quality and purity through third-party lab testing. Their products are designed to meet various health and wellness needs, providing consumers with reliable and effective CBD solutions. Cannarma’s commitment to quality assurance makes them a trusted name in the Indian CBD market.

These brands contribute significantly to the growing CBD industry in India, offering diverse products that cater to the increasing demand for natural wellness solutions.

The Hemp Company

The Hemp Company is recognized for its extensive range of hemp-based products, catering to various aspects of health and wellness. Their offerings include hemp seed oil, hemp hearts, and hemp protein powder, all derived from high-quality hemp seeds.

These products are rich in essential fatty acids, proteins, and other nutrients, promoting overall well-being.

The company emphasizes sustainable and ethical sourcing practices, ensuring that consumers receive products that are both beneficial to health and environmentally friendly. By focusing on quality and sustainability, The Hemp Company has established itself as a trusted name among health-conscious consumers in India.

They emphasize rigorous third-party lab testing to ensure the potency and purity of their products, which helps build trust with consumers.

The distribution landscape for CBD products in India is evolving, with various channels facilitating consumer access. Here’s an analytical overview of the primary retail and distribution channels:

Online Platforms

E-commerce has become a pivotal channel for CBD product distribution in India, offering consumers convenience and a broad selection. Specialized online retailers such as CBD Store India provide a diverse range of products, including oils, tinctures, edibles, and topicals.

These platforms often feature detailed product descriptions, usage guidelines, and customer reviews, aiding informed purchasing decisions.

Additionally, brands like Awshad operate their own e-commerce websites, offering full-spectrum CBD oils in various flavors.

The online model also enables brands to reach consumers in regions where physical retail presence is limited.

Retail Pharmacies and Specialty Stores

Physical retail outlets are increasingly incorporating CBD products into their offerings. For instance, HempStreet, recognized as India’s first and largest research-to-retail player in the medicinal cannabis space, has established a network of over 60,000 Ayurvedic practitioners across the country.

This extensive network facilitates the responsible dispensation of cannabis-based medications, integrating traditional medical advice with modern CBD products.

Such collaborations enhance consumer trust and provide professional guidance on product usage.

Ayurvedic Clinics and Wellness Centers

Given CBD’s association with wellness and therapeutic benefits, Ayurvedic clinics and wellness centers are emerging as significant distribution channels.

BOHECO’s Cannabis Health & Wellness Centres: Located in New Delhi and Bengaluru, these centers serve as comprehensive hubs for hemp and cannabis products. They offer consultations and a range of CBD-infused products, aligning with Ayurvedic principles.

HempCann Solutions: This organization combines traditional Ayurvedic knowledge with contemporary research to create medicinal products harnessing the benefits of the cannabis plant. Their offerings are designed to promote a healthier lifestyle through natural remedies.

These establishments often recommend CBD-infused products as part of holistic treatment plans, aligning with traditional Indian medicinal practices. The integration of CBD products into Ayurvedic treatments offers consumers a blend of traditional and contemporary therapeutic options.

Challenges in Distribution

Despite the growth in distribution channels, challenges persist. Regulatory uncertainties and varying state-level laws can complicate the distribution process.

Additionally, the need for consumer education on CBD’s benefits and legal status remains critical.

Retailers must navigate these challenges by ensuring compliance with local regulations and investing in consumer awareness initiatives.

India’s CBD regulations are a complex patchwork shaped by multiple authorities:

Key takeaway: India’s framework remains ambiguous — permissive towards hemp seed-based products and Ayurvedic use, but highly restricted for full-spectrum CBD oils or edibles.

Feature | United States | Canada | United Kingdom | India |

THC Limit (Hemp) | <0.3% | <0.3% | <0.2% | <0.3% (in hemp seed products) |

Federal/National Legality | Yes, with state variations | Fully legal & regulated | Legal with conditions | Limited – permits hemp seed & Ayurvedic use |

CBD in Food/Supplements | Not FDA approved | Regulated for edibles | Novel food regulation | FSSAI-regulated for hemp seeds only |

Medical Use | State-level programs | Legal under Cannabis Act | Prescription required | Permitted under Drugs & AYUSH licences |

Online Sales | Varies by state | Permitted via licensed sites | Permitted under guidelines | Common but lacks full regulatory support |

The distribution of CBD products in India is expanding through multiple channels, each contributing to increased accessibility and consumer education.

As the market matures, the synergy between online platforms, retail pharmacies, and wellness centers is likely to play a crucial role in shaping the future landscape of CBD product distribution in the country.

As global interest in cannabis wellness continues to accelerate, India finds itself at a strategic crossroads.

With its rich agricultural base, deep-rooted traditions in Ayurveda, and evolving regulatory landscape, the country holds untapped potential to emerge as a major player in the global hemp and CBD value chain.

From sustainable textiles to high-value nutraceutical exports, here’s how India could shape the future of the CBD economy.

Industrial hemp—a non-psychoactive variety of Cannabis sativa with THC levels below 0.3%—is gaining attention as an eco-friendly alternative to traditional crops.

Its fibres are known for being strong, breathable, and naturally antimicrobial, making them ideal for apparel, home textiles, and industrial applications.

India, a country with a strong legacy in natural fibres, is well-positioned to integrate hemp into its textile ecosystem.

Unlike cotton, hemp requires significantly less water and fewer pesticides, and can thrive in diverse climates across the subcontinent. States like Uttarakhand and Uttar Pradesh have already initiated policies to legalise hemp cultivation for industrial purposes.

By investing in the hemp textile supply chain—from farming and fibre processing to apparel manufacturing—India could reduce its reliance on cotton imports, cut down water usage, and build a more sustainable, homegrown textile economy.

Hemp seeds are emerging as nutritional powerhouses, rich in plant-based protein, dietary fibre, and essential fatty acids like omega-3 and omega-6. Their growing popularity in the health food and nutraceutical sectors worldwide positions India for high-potential exports.

The Food Safety and Standards Authority of India (FSSAI) has already approved hemp seeds and their derivatives for use in food products, laying the groundwork for compliant, standardised exports.

With rising global demand for clean-label, plant-based ingredients, India could scale its hemp-based nutraceutical offerings—especially protein powders, cold-pressed oils, and CBD derivatives—to markets across North America, Europe, and Asia-Pacific.

By adhering to global quality standards and leveraging its low-cost manufacturing advantage, India can create a lucrative export stream within the wellness food and supplement sectors.

India’s potential goes beyond cultivation—it also has the tools to become a global hub for CBD processing and manufacturing.

With extensive infrastructure in pharmaceuticals, biotechnology, and Ayurveda, the country can integrate modern cannabinoid extraction techniques with centuries-old herbal wisdom.

As one of the world’s largest producers of generic medicines, India already possesses the expertise in regulatory compliance, GMP-certified facilities, and precision-led manufacturing processes—all of which are applicable to CBD production. Coupled with a large, cost-effective labour force and access to raw materials, this makes India an attractive destination for global CBD players seeking a processing or packaging partner.

Despite these advantages, India’s regulatory framework remains fragmented. While the FSSAI has issued standards for hemp seeds, there is a lack of comprehensive national policy on CBD and THC-free derivatives. Regulatory inconsistencies between states further complicate licensing, logistics, and compliance.

For India to realise its export ambitions, national-level regulatory clarity is essential. This includes:

A cohesive, transparent regulatory ecosystem would de-risk investments, attract global partnerships, and position India as a trusted CBD exporter.

Global demand for CBD is growing steadily, driven by applications across health, skincare, functional food, and pharmaceuticals. Markets such as the US, UK, Germany, and Canada are actively sourcing CBD-based products, but require high standards of quality, traceability, and legal compliance.

India’s strengths in scale, cost-efficiency, and manufacturing make it a promising hub—but only if producers can meet these international benchmarks. THC content, labelling accuracy, third-party testing, and Good Manufacturing Practices (GMP) will all be non-negotiable for global buyers.

If these challenges are addressed strategically, India could emerge not just as a raw material supplier, but as a leading global processor and exporter of finished CBD products.

CBD products in India are steadily gaining traction, driven by rising consumer interest in wellness alternatives and evolving regulatory frameworks. However, the road to mainstream acceptance is still met with hurdles, including lingering social stigma, premium pricing, and the need for more clinical research to validate CBD’s effectiveness.

While the market is on an upward trajectory, sustained growth will depend on consumer education, regulatory clarity, and improved accessibility. As awareness spreads and policies become more defined, the CBD industry is expected to expand, reaching a broader audience beyond early adopters. Price normalization and greater transparency in product quality will further enhance trust and adoption.

Despite these challenges, India’s CBD market holds immense potential. As the global wellness trend shifts toward plant-based and holistic health solutions, CBD’s position in the Indian market is set to strengthen. The key question is not whether CBD will continue to grow in India, but how quickly it can overcome its barriers to become a mainstream wellness solution.

Need expert consultancy for your nutraceutical retail or CBD retail business? Contact us

CBD products in India are priced at a premium due to several factors. These include the high cost of extraction methods like CO₂ extraction, which require advanced technology and expertise. Quality hemp often needs to be imported or cultivated through organic farming, both of which raise costs. Regulatory grey areas and limited domestic production capacity lead to higher import duties and restricted supply. Additionally, brands must invest in third-party lab testing to ensure product safety and compliance. The niche nature of the market, combined with low consumer awareness, prevents economies of scale. Finally, expenses related to compliant packaging, branding, and specialised distribution add further to the cost.

Feature | Hemp Protein | CBD (Cannabidiol) |

|---|---|---|

Source | Hemp seeds | Flowers, leaves, stalks of hemp plant |

Primary Use | Nutrition, muscle recovery, vegan protein source | Wellness and therapeutic support (anxiety, pain, etc.) |

Key Compounds | Protein, omega fatty acids, fibre, minerals | Cannabidiol (CBD), terpenes, other cannabinoids |

THC Content | Negligible | Legally <0.3% in India (FSSAI and AYUSH compliant) |

Psychoactive? | No | No (if within legal THC limits) |

Legal Status | Legal under FSSAI for food use | Regulated; permitted in seed-derived or AYUSH-licensed forms |