Explore the booming ice cream market in India for 2024, highlighting key players, emerging trends, and growth drivers shaping the industry

The ice cream market in India is currently experiencing a significant transformation, fueled by emerging start-ups, innovation in flavors, and growing interest from investors.

At the heart of this shift is the pursuit of premium, artisanal, and preservative-free ice creams that appeal to Gen Z and the upper middle-class.

Traditional players like Amul, a well-known Indian brand offering a wide range of dairy products including ice cream, and Kwality Wall’s, popular for its diverse ice cream offerings, continue to dominate the market.

Vadilal, one of the oldest ice cream brands in India, is also known for its flavor range.

On the other hand, new entrants like Get-A-Whey, which focuses on protein-rich ice creams catering to health-conscious consumers, and Naturals Ice Cream, known for its fruit-based ice creams made from natural ingredients, are gaining significant traction.

NIC (Natural Ice Cream) specializes in premium, natural ingredient-based ice creams, adding to the dynamic growth of the industry.

Several factors are driving this growth, including rising consumer preferences for healthier options featuring natural ingredients, as well as innovative and exotic flavors.

Enhanced distribution strategies, including the growth of online sales and quick commerce, are making ice cream more accessible.

Additionally, India’s hot and tropical climate significantly boosts ice cream consumption, especially during the long summer months.

Economic factors such as increasing disposable incomes and the expansion of modern retail formats like supermarkets and hypermarkets are also contributing to market growth.

India’s ice cream market is expanding at an annual growth rate of 12-15%.

The sector is projected to grow from $3.4 billion in FY23 to over $5 billion by FY25, making it a lucrative target for potential buyers.

Key segments include traditional ice creams, gelatos, and healthier alternatives like low-sugar and vegan options, reflecting a shift in consumer preferences toward premium products.

Indian Ice Cream Market Segments

Segment | Brand Examples | Pricing (INR) | Differentiation | Characteristics |

Traditional Ice Cream | Amul, Kwality Walls, Vadilal, Mother Dairy, HUL (Cornetto, Magnum), Giani’s, Havmor | 50-150 | Mass appeal, various flavors, strong distribution networks | Widely available, affordable, appeals to a broad demographic |

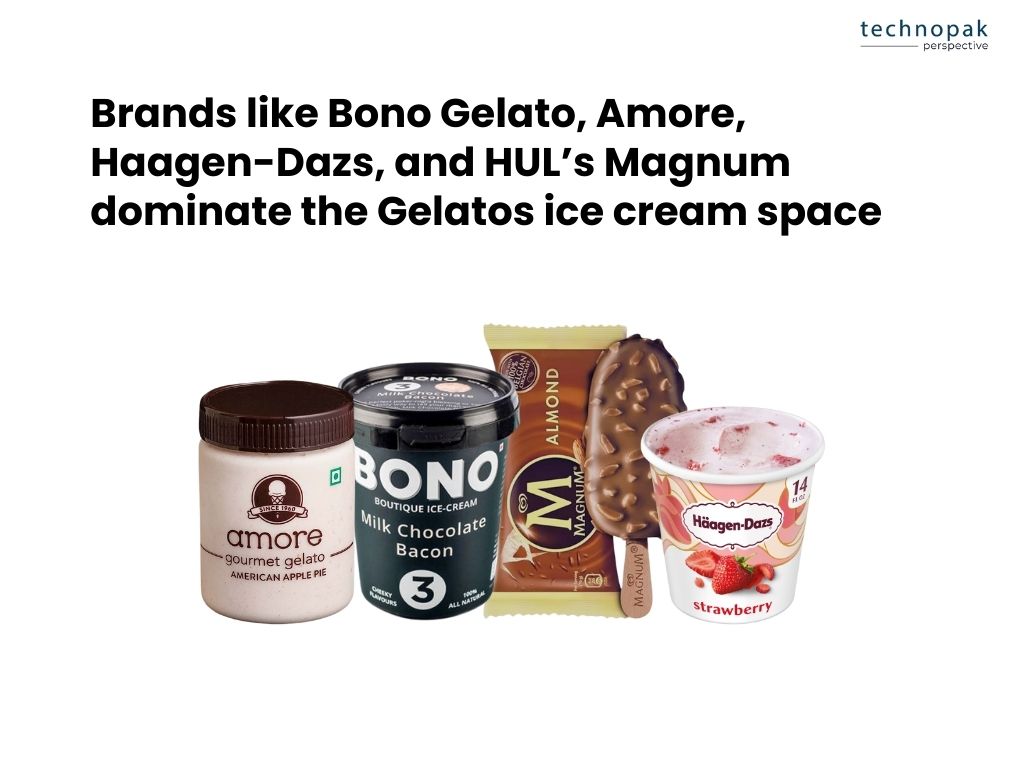

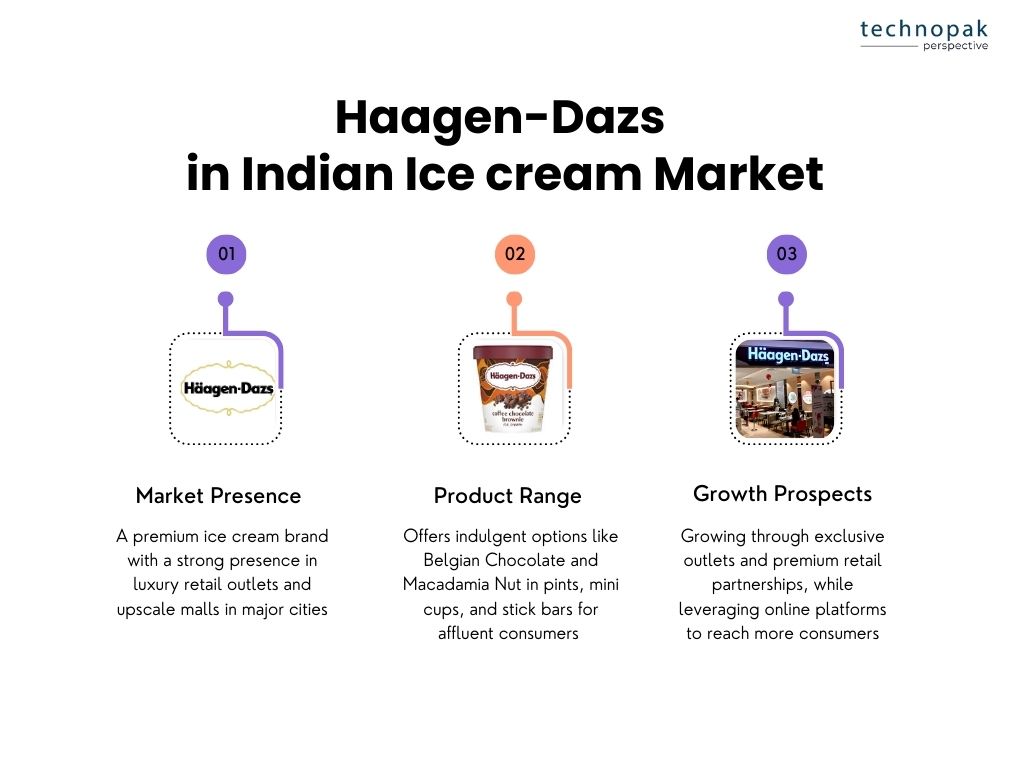

Gelatos | Bono Gelato, Amore, Haagen-Dazs, HUL (Magnum) | 150-300 | Creamier, premium product, often imported or international | Denser, richer in texture, premium pricing |

Low-Sugar | Amul, Denali, Brooklyn Creamery, Mother Dairy, Vadilal | 80-200 | Low in sugar for health-conscious consumers | Healthier option, lower calories, sugar-free |

Vegan | WhiteCub, Baskin Robbins, Brooklyn Creamery | 100-250 | Dairy-free, plant-based, targeting vegans and lactose intolerant consumers | Eco-conscious, focuses on plant-based ingredients |

Frozen Yogurt | Cocoberry, Yogurtbay, Baskin Robbins | 100-200 | Low-fat, probiotic benefits, guilt-free indulgence | Health-focused, lower calories, urban presence |

Artisanal Ice Cream | Minus 30, Naturals, Keventers, Hangyo | 200-400 | Small-batch, unique flavors with artisanal focus | High-quality ingredients, organic, locally sourced |

Kulfi | Vadilal, Mother Dairy, Hangyo, Giani’s | 20-100 | Traditional Indian dessert with nostalgic appeal | Popular in rural and semi-urban areas, nostalgic flavors |

Soft Serve | McDonald’s, Kwality Walls, Baskin Robbins | 30-100 | Convenient, quick-serve, affordable | Instantly served, lower cost, widely available |

Dairy-Free/Lactose-Free | WhiteCub, Epigamia, Brooklyn Creamery | 100-250 | Caters to lactose-intolerant consumers, allergy-friendly | Suitable for allergy-sensitive and lactose-intolerant |

Regional Flavors | Amul, Havmor, Nirula’s, Naturals, Hocco | 50-200 | Uses local spices, fruits, and flavors | Focus on regional and ethnic flavors with local ingredients |

Functional Ice Cream | Guilt-Free, Epigamia, Brooklyn Creamery | 150-350 | Infused with added health benefits like probiotics or nutrients | Premium pricing, caters to health-conscious consumers |

The Indian ice cream market is highly diverse, catering to a wide range of consumer preferences, from traditional favorites to health-conscious alternatives and premium indulgences. Each segment reflects different consumer trends and demands, supported by both local and global brands. Here’s a closer look at the key segments:

Traditional Ice Cream remains the backbone of the Indian market, dominated by popular brands like Amul, Kwality Walls, Vadilal, Mother Dairy, and HUL (with well-known names like Cornetto and Magnum). These brands offer a wide range of flavors, from vanilla and chocolate to more exotic tastes, ensuring mass appeal. With affordable pricing ranging from ₹50 to ₹150, traditional ice creams are accessible to all demographics. Their strong distribution networks, particularly in urban and semi-urban areas, ensure widespread availability, making them a staple in Indian households.

Gelatos, on the other hand, cater to a more premium segment, offering a creamier and denser texture. Brands like Bono Gelato, Amore, Haagen-Dazs, and HUL’s Magnum dominate this space, with pricing between ₹150 and ₹300. These brands emphasize richness and quality, often incorporating international flavors. Gelatos are particularly popular in metropolitan areas, appealing to consumers who are willing to pay for a more indulgent experience.

As health-conscious consumers continue to grow in India, Low-Sugar ice creams have gained popularity. Brands such as Amul, Denali, Brooklyn Creamery, and Mother Dairy have introduced low-sugar variants to meet the demand for guilt-free desserts. Priced between ₹80 and ₹200, these options cater to consumers looking for lower-calorie alternatives without compromising on taste. They often emphasize the use of natural sweeteners and fewer artificial additives.

Similarly, the rise of plant-based diets has fueled demand for Vegan ice creams. WhiteCub, Baskin Robbins, and Brooklyn Creamery offer a range of dairy-free products, with prices ranging from ₹100 to ₹250. These vegan options cater not only to vegans but also to consumers who are lactose intolerant or looking for more eco-friendly choices. With increasing environmental awareness, vegan ice creams have become a growing segment in urban markets.

Frozen Yogurt is another health-conscious alternative, known for its lower fat content and probiotic benefits. Brands like Cocoberry and Yogurtbay, alongside Baskin Robbins, have tapped into this market, offering a variety of flavors with prices ranging from ₹100 to ₹200. Frozen yogurt has gained a loyal customer base among fitness enthusiasts and those seeking healthier dessert options, particularly in metro cities.

The Artisanal Ice Cream segment appeals to those who seek unique, small-batch flavors made with high-quality ingredients. Brands like Minus 30, Naturals, Keventers, Hangyo emphasize the use of fresh, organic ingredients, offering a premium experience at prices between ₹200 and ₹400. These ice creams often feature innovative flavors, such as those inspired by local produce or regional specialties, and are particularly popular among consumers seeking a more luxurious and authentic experience.

Kulfi, a traditional Indian dessert, continues to hold its ground, especially in rural and semi-urban areas. Brands like Vadilal, Mother Dairy, Hangyo, and Giani’s offer both traditional and modern variations of this classic, with prices ranging from ₹20 to ₹100. Kulfi, with its rich and creamy texture, has nostalgic value for many Indians and remains a go-to dessert in both informal and festive settings.

In the Soft Serve category, McDonald’s, Kwality Walls, and Baskin Robbins dominate with affordable, instantly served ice creams, priced between ₹30 and ₹100. Soft serve is widely available at fast food outlets and kiosks, offering a convenient option for consumers on the go. The appeal of soft serve lies in its accessibility, low cost, and quick service, making it popular across a wide demographic.

Regional flavors, such as those offered by Naturals, also remain a major draw for consumers seeking authentic, locally-inspired options.

Lastly, the niche but growing market for functional ice creams, which offer added health benefits such as probiotics or nutrients, is being driven by brands like Guilt-Free and Epigamia. As consumers become more health-conscious, functional ice creams that combine indulgence with health benefits are likely to see continued growth.

Rising disposable incomes, urbanization, and evolving tastes are key factors contributing to this growth, especially in tier-1 and tier-2 cities.

The Indian ice cream market is witnessing dynamic growth, driven by various players ranging from multinational corporations to homegrown startups.

Below is a detailed analysis of the key industry players, their market positioning, recent developments, and performance metrics:

Shareholders of HUL will receive shares in the new entity, aiming to unlock fair value and provide flexibility for future growth. The demerger will create a focused management team for the ice cream business, enhancing its ability to address market challenges and capitalize on opportunities. Preparatory steps are underway, with final approvals expected early this year.

Market Presence: Giani’s is a traditional and well-established ice cream brand with a strong foothold in Northern India, particularly known for its presence in Delhi and NCR. It has a loyal customer base, especially for its traditional sundaes and ice cream varieties.

Product Range: The brand offers a variety of ice creams and sundaes, catering to both mass-market consumers and premium customers. Its product portfolio includes classic Indian flavors such as Kesar Pista, Mango, and Rabri Faluda, along with Western flavors and sundaes.

Growth Prospects: Giani’s is expanding through franchising, with a focus on increasing its footprint in southern and western India. Their competitive pricing and diverse product range enable them to appeal to a broad demographic, from mass-market consumers to those seeking premium indulgence. As they continue to enter new regions, Giani’s is expected to solidify its presence in the national ice cream landscape.

India’s ice cream industry is witnessing a surge in investments, reflecting the sector’s growing appeal among consumers and investors alike.

Key Funding Highlights

Noteworthy deals include Hangyo’s $25 million private equity round and NOTO’s $4.58 million across four rounds.

These numbers reflect investor confidence in India’s ice cream potential.

The growing demand for premium and artisanal ice creams in India is largely driven by rising consumer interest in health-conscious options.

This trend is evident in the increasing popularity of niche segments offering low-calorie, vegan, and sugar-free varieties.

Start-ups like Get-A-Whey, which focuses on healthy ice creams, have successfully tapped into this trend, securing $3.5 million in a seed round to support their expansion.

Traditional mass-market ice creams remain popular, but there is a noticeable shift towards premium products.

Consumers are willing to pay more for ice creams made with superior-quality ingredients and innovative flavors.

For instance, Naturals Ice Cream, known for its fruit-based ice creams made from natural ingredients, and NIC (Natural Ice Cream), which specializes in premium, natural ingredient-based ice creams, are gaining significant traction.

The health-conscious segment is particularly driven by rising health awareness among consumers.

This has led to a surge in demand for healthier ice cream options, such as those that are low in sugar and fat, or entirely dairy-free.

The premium segment is also seeing growth due to the introduction of unique and exotic flavors, such as salted caramel, matcha, and tiramisu, which cater to the evolving tastes of Indian consumers.

This dynamic environment is fostering a diverse range of products that cater to both indulgent and health-conscious consumers.

The vegan movement in India is gaining ground rapidly, with more people shunning food derived from animal sources.

This shift has prompted ice cream manufacturers, particularly in the MSME sector, to innovate and create variants using coconut milk, peanut milk, and soymilk.

These vegan ice creams are now available in various flavors and compare favorably with their milk and yogurt-based counterparts.

Nomou is a brand known for its creamy, plant-based gelatos that cater to health-conscious consumers.

WhiteCub is one of the pioneering vegan ice cream brands in India, offering a wide range of dairy-free options.

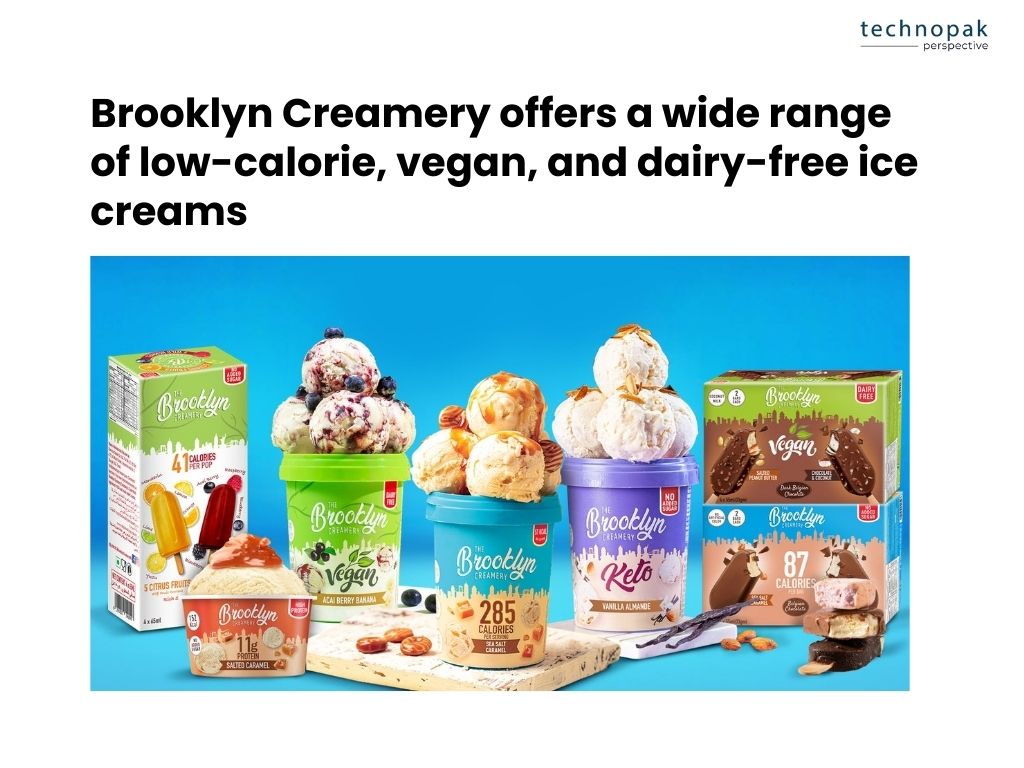

Brooklyn Creamery offers a wide range of low-calorie, vegan, and dairy-free ice creams, with indulgent flavors like Chocolate Fudge Brownie and Sea Salt Caramel, catering to urban, health-conscious consumers.

Arctic Fox is known for its almond and coconut milk-based vegan ice creams, providing creamy, plant-based alternatives with rich flavors like Belgian Chocolate and Vanilla Bean.

Naturally Yours focuses on all-natural ingredients, using coconut milk to create its vegan ice creams, which emphasize both taste and health benefits with flavors like Tender Coconut and Mango Sorbet.

Papacream is popular for its innovative and refreshing sorbet flavors.

Vegan Heart focuses on delivering rich and indulgent vegan ice cream experiences.

Belo Pops uses walnut milk to create its unique flavors, catering to those looking for dairy-free alternatives.

The availability of diverse flavors and the competitive pricing make vegan ice creams an attractive choice for many.

India’s ice cream market has experienced robust growth over the last decade, driven by rising disposable incomes, a growing affinity for premium products, and evolving consumer preferences for healthy and unique flavors.

A significant sub-segment within this industry is artisanal ice cream, which stands out for its handcrafted processes, natural ingredients, and exclusive flavors that appeal to discerning consumers.

1. Market Size and Growth

The artisanal ice cream segment, though relatively niche, has shown higher growth compared to mass-market brands.

In 2024, the artisanal ice cream segment in India is estimated to have grown by 20-25% annually, contributing approximately $150 million to the overall ice cream market, which is valued at around $2.3 billion. This growth is driven by increasing consumer preferences for premium, natural ingredients and unique flavors. The overall ice cream market in India is expanding at an annual growth rate of 12-15%, projected to grow from $3.4 billion in FY23 to over $5 billion by FY25

This growth is propelled by increasing consumer demand for quality over quantity, personalized experiences, and healthier, organic options.

2. Key Consumer Demographics

Artisanal ice cream appeals largely to urban, health-conscious, and affluent millennials.

According to industry data, about 60% of artisanal ice cream consumers are from metropolitan cities such as Mumbai, Delhi, Bengaluru, and Hyderabad.

Additionally, 45% of consumers fall within the age group of 25-40 years, who are drawn to the unique flavor combinations, sustainability aspects, and clean-label ingredients associated with artisanal brands.

3. Flavors and Ingredients Trends

The rise in demand for innovative flavors has played a pivotal role in the growth of this market.

Traditional mass-market flavors such as vanilla and chocolate are being outpaced by artisanal offerings like rose-pistachio, salted caramel, matcha, and vegan coconut milk variants.

A Nielsen report in 2022 revealed that 35% of consumers are willing to pay a premium for ice cream made from natural ingredients like organic milk, fruit pulp, and raw honey.

There is also a growing trend of vegan and lactose-free ice creams, which saw a growth of 30% in demand from 2021 to 2023.

4. Distribution Channels

While traditional ice cream is predominantly sold through retail stores and parlors, artisanal ice cream brands have leveraged a mix of direct-to-consumer (D2C) models and premium retail outlets.

Approximately 40% of artisanal ice cream sales are now conducted online, facilitated by e-commerce platforms such as Swiggy and Zomato as well as brand-owned websites.

Specialty stores and gourmet food outlets also account for 25-30% of total sales.

5. Competitive Landscape

The artisanal ice cream market in India is fragmented, with several emerging players carving a niche for themselves.

Popular brands like Papacream, Naturals, and Minus 30 are capitalizing on consumers’ desire for premium, small-batch ice creams.

Newer entrants such as Glen’s Bakehouse and NIC Natural Ice Creams.

6. Innovation in Production and Packaging

Artisanal ice cream brands will need to continuously innovate in both their production processes and packaging to meet consumer demands.

In terms of production, the use of advanced freezing technologies to maintain the creamy texture and preserve the freshness of natural ingredients is essential.

Additionally, innovations in portion control (mini tubs, popsicles) and packaging designed for eco-conscious consumers (biodegradable and recyclable materials) will become key differentiators in this competitive market.

7. Collaborations and Brand Loyalty

Collaborations between artisanal ice cream brands and restaurants, cafes, and gourmet stores are becoming more frequent.

These partnerships allow brands to expand their distribution channels while maintaining the exclusivity that artisanal products are known for.

Additionally, building brand loyalty through personalized experiences (such as customizable flavors or limited-edition products) will be crucial for driving repeat business.

Offering subscription models where customers receive curated assortments or special seasonal flavors could also foster long-term customer engagement.

8. Market Entry Barriers

For new entrants, the artisanal ice cream market offers substantial potential, but there are inherent barriers:

This can be a significant challenge due to the inconsistent logistics network in certain parts of India.

Artisanal ice cream brands that can offer products with clear nutritional benefits, such as added probiotics, plant-based alternatives, and organic ingredients, will find a ready market.

Artisanal ice cream brands that focus on sustainable sourcing of ingredients, eco-friendly packaging, and local partnerships with farmers and producers will have a competitive edge.

A 2022 PwC survey found that 55% of Indian consumers are more likely to purchase from brands that demonstrate ethical and sustainable practices.

Flavors inspired by regional fruits, spices, and traditional sweets such as mango, saffron, kulfi, and cardamom have become increasingly popular.

Consumers are keen to explore more exotic flavor profiles, which provides an opportunity for brands to localize their offerings and create unique selling propositions.

Developing robust D2C strategies, improving delivery infrastructure, and leveraging social media marketing will allow artisanal ice cream brands to connect with millennial and Gen Z consumers who are the primary drivers of online purchases.

Hindustan Unilever (HUL), a dominant player in the Indian ice cream sector, had, until recently, firmed its focus on expanding its Kwality Walls brand while diversifying into premium segments.

HUL’s strategy included strengthening its presence in the e-commerce space and introducing innovative flavors to meet evolving consumer tastes.

The company also made plans to boost its out-of-home consumption segment, capitalizing on India’s growing demand for impulse buying in urban areas.

However, Hindustan Unilever (HUL) is currently exploring strategic options for its ice cream business, sparking considerable interest among major companies in the food and beverage sector.

Following the formation of a committee of independent directors to assess the future of its ice cream division, there is widespread speculation about a possible sale.

Leading corporations such as RJ Corp, MMG Group, and Nestlé SA are keeping a close eye on developments, as they see significant synergies in acquiring the business.

RJ Corp, which owns the Cream Bell ice cream brand, as well as franchises for KFC and Pizza Hut, sees potential in expanding its footprint in the ice cream market.

Similarly, MMG Group, which operates McDonald’s in parts of India, already possesses the infrastructure for cold chain and frozen dessert distribution, making it a logical contender.

Nestlé, which previously exited the Indian ice cream market due to high pricing issues with its Movenpick brand, might reconsider entry if the HUL division becomes available.

HUL’s ice cream brands, which include Kwality Wall’s, Cornetto, and Magnum, currently represent around 3% of the company’s total revenue, contributing to its over ₹60,000 crore annual sales.

This business segment’s valuation is expected to be central to any acquisition discussions.

As Unilever, HUL’s parent company, is the world’s largest ice cream manufacturer, with iconic global brands such as Ben & Jerry’s and Magnum, the potential sale could be highly attractive, especially given India’s rapidly expanding ice cream market.

India’s ice cream market is ripe for growth, with premiumization, health-consciousness, and urbanization acting as key drivers.

The influx of private funding and innovative players promises to reshape the industry, creating ample opportunities for both established brands and new entrants.

The future of ice cream in India is not just sweet, but lucrative.

Are you an ice cream or FMCG brand looking to ride the Indian business growth wave?

Get in touch today for customized strategies to help you outdo competition.