As the Indian Fast-Moving Consumer Goods (FMCG) sector approaches 2025, it stands at a pivotal juncture marked by both challenges and opportunities.

As the Indian Fast-Moving Consumer Goods (FMCG) sector approaches 2025, it stands at a pivotal juncture marked by both challenges and opportunities.

With a projected market size of $220 billion by 2025, growing at a compound annual growth rate (CAGR) of 14.9% from $167 billion in 2023, the sector is poised for significant growth driven by rural resurgence, digital transformation, and a shift towards premium and sustainable products.

However, navigating this transforming landscape requires addressing the slowdown in urban demand, rising raw material costs, and an increasingly competitive market.

Companies like Hindustan Unilever (HUL) and Godrej Consumer have recently unveiled their strategic blueprints, offering valuable insights into broader sectoral adjustments expected by 2025.

While brand-specific moves highlight tactical decisions, it’s essential to understand the overarching trends shaping the FMCG industry’s trajectory.

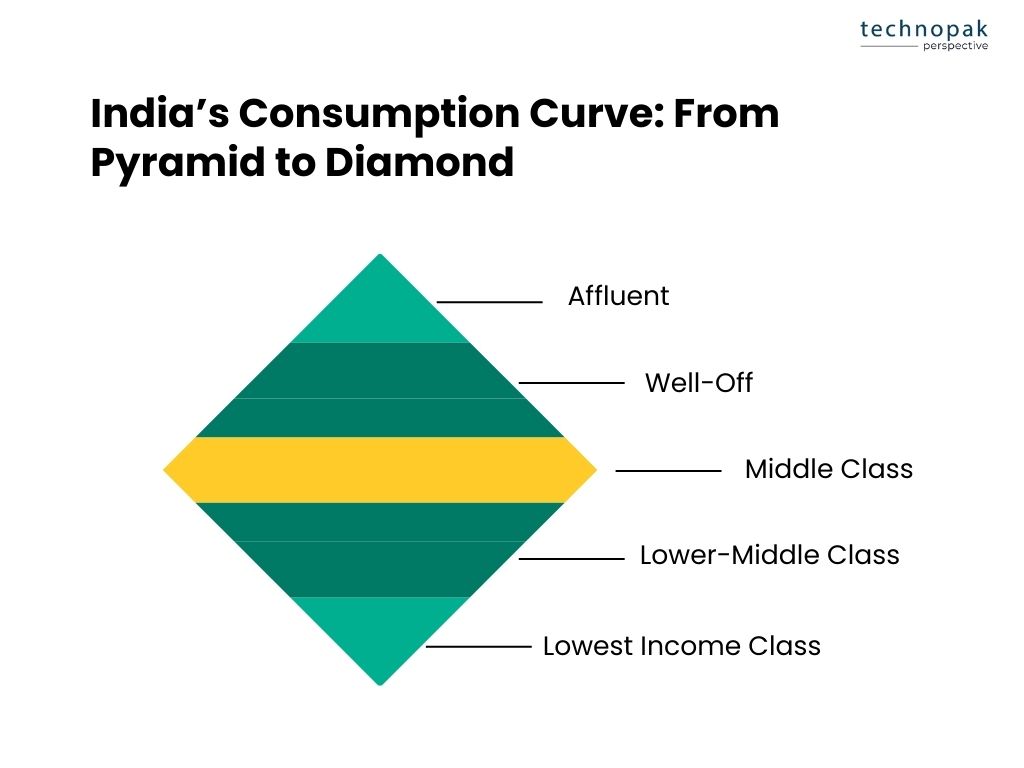

As disposable incomes rise and India’s middle class expands, the traditional income pyramid—characterized by a large low-income base and a small high-income apex—is transforming into a diamond shape.

This shift indicates a growing middle class, which now forms the largest segment of the population, while the low-income group shrinks and the high-income group remains relatively small.

This change leads to increased consumer spending, greater market opportunities for businesses, and enhanced economic stability, as a substantial middle class drives economic activity and growth.

This shift is driving demand for premium personal care, home care, and wellness products.

Consumers are transitioning from basic products like detergent powders to premium liquid detergents and body washes, reflecting an inclination toward convenience and efficacy.

By 2030, the number of Indian households earning between $8,500 and $40,000 annually is expected to grow significantly. In Indian Rupees (INR), this range translates to approximately ₹700,000 to ₹3,300,000 per year, based on current exchange rates.

According to a McKinsey report, India is projected to have the third-largest number of high-income households globally by 2030, just behind China and the United States.

The rise in affluence is also mirrored in metro areas, where consumers increasingly spend on premium skincare, wellness, and experiences like travel and entertainment.

Digital adoption continues to redefine FMCG consumption patterns.

Online shopping is growing exponentially, allowing companies to engage directly with consumers through digital platforms and expand access to aspirational and niche products.

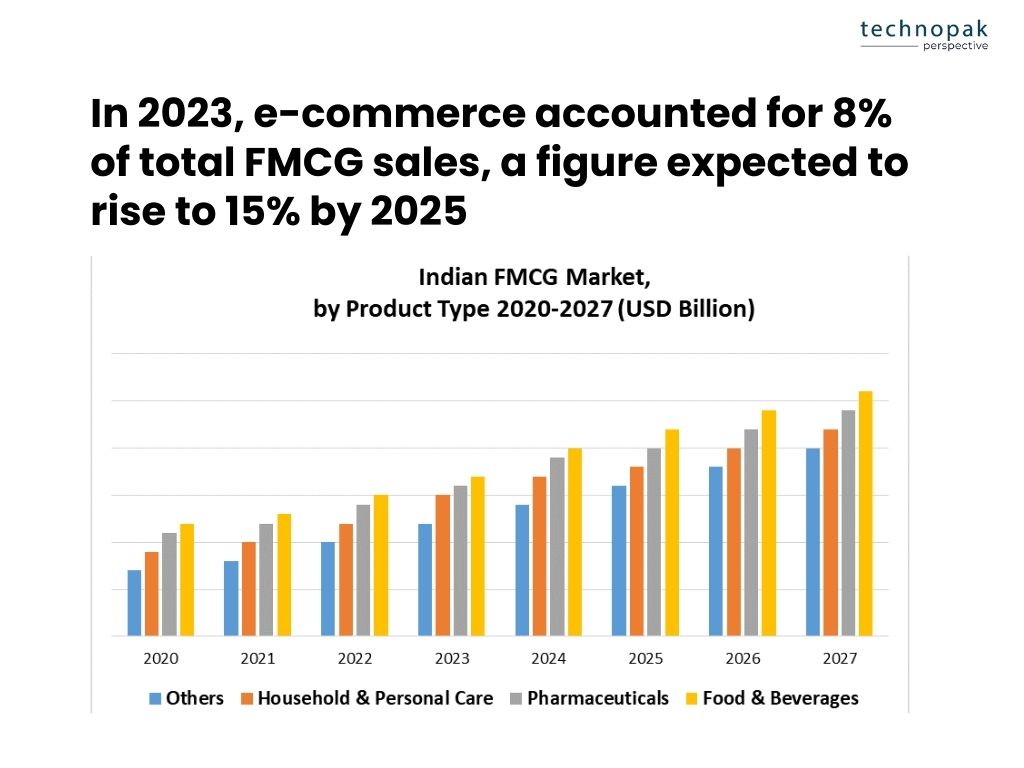

In 2023, e-commerce accounted for 8% of total FMCG sales, a figure expected to rise to 15% by 2025

FMCG giants are leveraging data analytics to predict trends and tailor products, strengthening their digital-first strategies to tap into India’s tech-savvy population.

For instance, Hindustan Unilever uses AI-driven insights to optimize its supply chain and personalize marketing campaigns

Similarly, ITC has launched several digital initiatives, including an app for farmers to streamline procurement and improve product quality.

Moreover, the rise of quick commerce platforms like Blinkit and Swiggy Instamart has further accelerated digital transformation.

Health-consciousness is a dominant theme, with more consumers seeking natural, organic, and wellness-focused products.

Categories like premium face care, serums, and sun protection are gaining traction, with the skincare market expected to grow at a CAGR of 9.5% from 2023 to 2028.

Healthy foods and supplements are fast becoming staples in urban households, with the health and wellness food market projected to reach ₹1.5 trillion by 2025.

This trend aligns with the increasing emphasis on preventative healthcare and lifestyle improvements.

For example, Dabur has seen a significant rise in demand for its Chyawanprash and honey products, driven by consumers’ focus on immunity-boosting foods.

Similarly, Patanjali has expanded its range of natural and organic products to cater to this growing demand.

The demand for ready-to-use products, such as liquid detergents and packaged mini-meals, underscores a significant shift toward convenience-driven lifestyles.

This trend is particularly pronounced in urban areas, where factors like urbanization, the rise of nuclear families, and time-poor households are accelerating the need for convenient solutions

For instance, the market for packaged mini-meals has grown by 15% annually, reflecting the increasing preference for quick and easy meal options

Similarly, the liquid detergent segment has seen a surge in demand, with a growth rate of 12% per year, as consumers seek hassle-free cleaning solutions.

FMCG companies are capitalizing on this trend by expanding their product portfolios to include more ready-to-use and convenience-focused products.

The FMCG landscape is witnessing intensified competition from agile, direct-to-consumer (D2C) brands like MamaEarth, Plum, and Sugar Cosmetics.

These players cater to niche preferences with innovative offerings, disrupting traditional market dynamics.

Established players are countering this by premiumizing their portfolios and introducing global brands tailored to Indian tastes.

For an in-depth analysis of the booming Direct-to-Consumer (D2C) market and its future prospects, don’t miss Technopak’s White Paper on D2C brands and their growth trajectory.

Despite optimism, recent financial updates suggest that growth in the FMCG sector may not be uniform across all categories.

Companies like Godrej Consumer and Hindustan Unilever (HUL) have experienced pressure on margins and volume growth in certain segments.

A combination of inflationary pressures and demand fluctuations in rural markets poses significant challenges.

Climate change has led to erratic weather patterns, affecting agricultural productivity and supply chains.

The 2024 monsoon season, while sufficient overall, was marked by extreme rainfall events, disrupting farming activities and impacting rural incomes

This uneven distribution of rainfall has posed challenges for water management and agricultural planning.

Rural consumption, a critical volume driver for the FMCG sector, has been marred by inflation.

Rising prices of essential goods have eroded purchasing power, leading to cautious spending among rural consumers.

Although there were signs of recovery in rural markets in mid-2024, the overall growth remains fragile and heavily influenced by inflationary pressures.

The Indian government has increased Minimum Support Prices (MSP) for various crops to ensure remunerative prices for farmers.

Additionally, welfare schemes such as the PM Kisan scheme and other social security measures have been implemented to support rural incomes.

These initiatives aim to stabilize rural consumption and provide a safety net for farmers.

While urban markets are driving premiumization, with consumers increasingly opting for high-end products, rural consumption remains essential for overall sector growth.

The slower recovery in rural areas could temper the sector’s momentum, highlighting the need for balanced growth strategies that address both urban and rural markets

Company | Commentary | Business Update |

Dabur | “Moderating inflation coupled with buoyant consumer sentiments and our focused investment in distribution footprint expansion in rural India helped demand from the hinterland bounce back for Dabur.” | Reported a 5% YoY increase in Q2 FY24-25 revenue to ₹3,029 crore, with strong rural growth and a 13% rise in international business. Maintained market share gains across 95% of its portfolio. |

Emami | “Our strategic acquisitions and cost management have helped us achieve robust performance, with a 45% revenue contribution from acquired brands.” | Saw a 12% rise in consolidated profit after tax to ₹261 crore for Q3 FY24, driven by reduced input costs and strong international business growth. |

Nestlé | “We delivered organic sales growth, driven by positive real internal growth. Consumer demand has weakened in recent months, and we expect the demand environment to remain soft.” | Expects improved organic sales growth in 2025 compared to 2024. Continues to focus on wellness, nutrition, and health, maintaining strong market leadership with brands like Maggi and Nescafé. |

Tata Consumer | “Our strong performance across beverages and foods, coupled with digital channel expansion, has driven our growth this quarter.” | Reported a 9% revenue growth in Q3 FY24, driven by strong performance across beverages and foods. Expanding product portfolio and leveraging digital channels to enhance market reach. |

Patanjali | “Despite challenges such as input price inflation, our focus on premium product launches and expanding branded sales has driven significant growth.” | Saw a 55.09% YoY growth in its Food & FMCG segment, with significant volume increases in edible oils and biscuits. Focused on premium product launches and expanding branded sales. |

Colgate | “We are very pleased to have delivered another quarter of strong top and bottom line results with earnings exceeding our expectations.” | Reported a 2.4% increase in net sales for Q3 2024, with a 6.8% growth in organic sales. Continues to lead in the toothpaste and manual toothbrush segments globally. |

Britannia | “Urban markets contributed significantly to the overall slowdown. We are closely monitoring the commodity situation and assessing its impact.” | Reported a revenue of ₹4,192 crore for Q3 FY24, with a minor 2% YoY increase. Focused on cost-efficiency measures and price hikes to manage inflationary pressures. |

Godrej Consumer | “The surge in palm oil and derivatives prices has impacted the soaps category, which represents one-third of our standalone business revenue.” | Issued a weak Q3 update, citing subdued demand and margin pressures due to inflation and weather impacts. Expects volume growth to normalize once prices stabilize. |

Marico | “Overall demand trends are stable but not buoyant; rural and HPC remain laggards.” | Reported low single-digit domestic volume growth in Q3 FY24, with strong performance in international markets. Focusing on premium personal care and foods, and expects a gradual recovery in consumption trends. |

Procter & Gamble | “Fiscal year 2024 was another year of strong results for P&G. We remain committed to our integrated strategy aimed at delivering sustainable, balanced growth and value creation.” | Reported net sales of $84 billion for FY24, with a 2% increase from the prior year. Focused on innovation, brand building, and sustainability initiatives. |

ITC | “We are focusing on premiumization and expanding our product portfolio to drive growth in a challenging market environment.” | Faced margin pressures due to rising commodity prices and weak urban demand. Focusing on premiumization and expanding product portfolio to drive growth. |

The consumption inequality between rural and urban India has narrowed significantly in 2023-24, driven by notable increases in Monthly Per Capita Consumption Expenditure (MPCE) in both areas. According to the latest Household Consumption Expenditure Survey (HCES), the average MPCE in rural India rose by 9.2% to ₹4,122, while in urban areas, it increased by 8.3% to ₹6,996.

This trend reflects a broader shift in consumption patterns, with non-food items continuing to dominate expenditures. In rural areas, non-food items accounted for 51.6% of the average MPCE, while in urban areas, they made up 59.7%.

The urban-rural gap in MPCE has declined to 69.7% in 2023-24 from 71.2% in 2022-23, and 83.9% in 2011-12.

Government support has played a crucial role in this growth, particularly through social welfare programs that have bolstered rural consumption. For instance, the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) provided free food grains to millions of rural households, significantly impacting their consumption patterns.

Additionally, rural infrastructure development and increased connectivity have facilitated better access to markets and services, further driving consumption growth.

The survey also highlighted a decrease in consumption inequality within both rural and urban areas. The Gini coefficient, a measure of income inequality, dropped in both regions during August 2023-July 2024 compared to the previous year.

Spending by the bottom 5% of households increased by 22.1% in rural areas and 18.7% in urban areas, while spending by the top 5% declined by 3.5% and 2.5%, respectively.

This closing gap is a testament to the sustained momentum of consumption growth in rural areas, supported by government initiatives and a resilient rural economy. As rural consumption continues to rise, it is expected to play a pivotal role in driving overall economic growth and reducing inequality in India.

The Indian Fast-Moving Consumer Goods (FMCG) sector has been experiencing a slowdown since the second half of the financial year 2022-2023.

This period marked the beginning of significant challenges, including inflationary pressures and reduced urban demand.

The slowdown continued through FY 2023-2024, with companies like Godrej Consumer and Hindustan Unilever (HUL) reporting pressure on margins and volume growth.

The urban FMCG market is experiencing a slowdown due to several economic pressures and challenges:

The sector is expected to face ongoing challenges into FY 2024-2025. Analysts predict that the recovery will be gradual, with urban demand remaining subdued due to economic pressures and inflation. While rural markets show some resilience, their recovery is fragile and insufficient to fully offset the urban decline. The overall outlook suggests that the FMCG sector may not see uniform growth across all categories until at least the end of FY 2024-2025.

The rise of quick commerce in India has significantly impacted traditional FMCG distributors and kirana stores, particularly in urban areas. Here’s a closer look at the challenges they face and the dynamics at play.

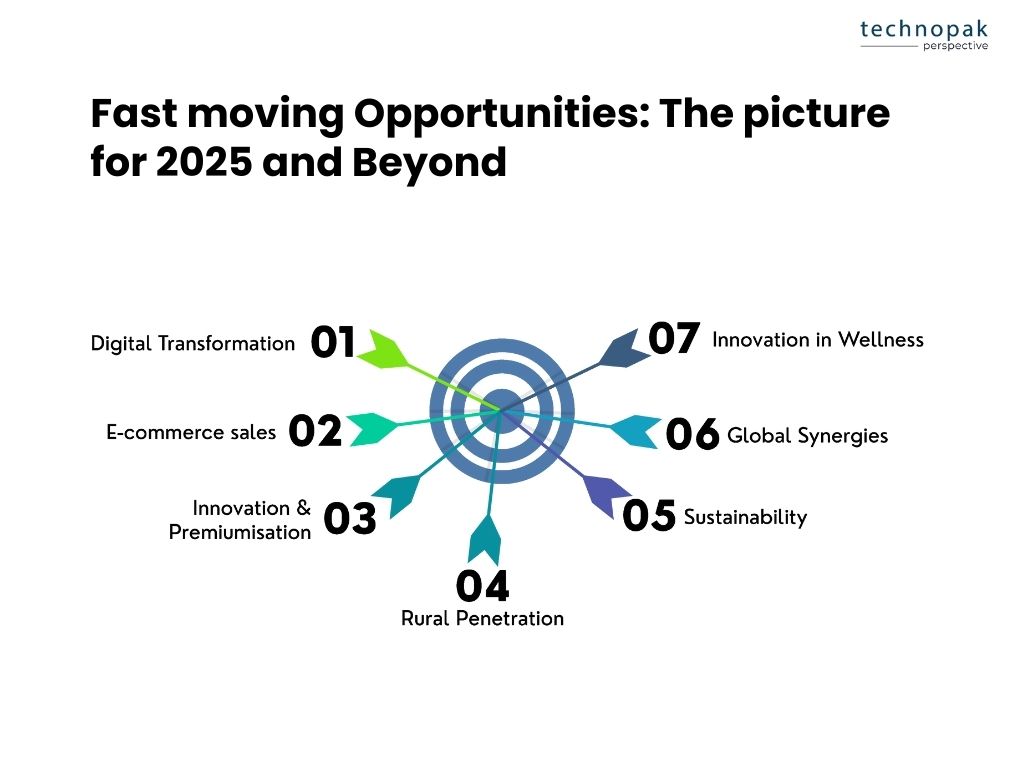

The Indian FMCG sector is poised for significant growth and transformation, driven by several key opportunities and trends:

The quick commerce sector in India has experienced significant growth, driven by consumer demand for rapid delivery and convenience.

This expansion has attracted big conglomerates, intensifying competition and reshaping the retail landscape.

Company | Description | USP | Operational Areas | Headquarters | Private Equity Backers | Year Started |

Blinkit | Formerly Grofers, offers express grocery delivery services. | 10-minute delivery, also offers printouts, pioneer in quick commerce | 30+ cities (Tier 1 & 2) | Gurgaon, Haryana | SoftBank, Tiger Global, Sequoia Capital | 2013 |

Zepto | Known for ultra-fast delivery of groceries and essentials. | 10-minute delivery, pioneer in quick commerce | 10 metropolitan areas | Mumbai, Maharashtra | Y Combinator, Nexus Venture Partners | 2021 |

Swiggy Instamart | Swiggy’s service for rapid delivery of groceries and essentials. | 10-minute delivery, part of Swiggy’s super app which includes Dineout, Genie, Instamart, and food delivery | 43 cities (Tier 1 & 2) | Bangalore, Karnataka | Prosus, SoftBank, Accel | 2020 |

BigBasket | Established online grocery platform with quick commerce services. | Wide range of products, Super Saver mode for greater assortment, BigBasket Now for instant delivery | 30+ cities (Tier 1 & 2) | Bangalore, Karnataka | Tata Digital | 2011 |

Flipkart Minutes | Flipkart’s service for delivering groceries and essentials within 90 minutes. | 10-15 minute delivery, late entrant | 20 cities (Tier 1 & 2) | Bangalore, Karnataka | Walmart | 2024 |

Dunzo Daily | Dunzo’s quick commerce service for groceries and daily essentials. | 19-minute delivery | 8 cities (Tier 1) | Bangalore, Karnataka | Reliance Retail, Lightbox, Alteria Capital | 2021 |

Amazon Tez | Amazon’s service for fast delivery of groceries and household items. | 10-15 minute delivery, late entrant | Select locations (Tier 1) | Bangalore, Karnataka | Amazon | 2024 |

Myntra M-Now | Myntra’s quick commerce initiative for fashion and lifestyle products. | 30-minute delivery | Bengaluru (expanding) | Bangalore, Karnataka | Flipkart | 2024 |

Slikk | New entrant focusing on fast delivery of groceries and essentials. | Fast delivery | Noida (expanding) | Noida, Uttar Pradesh | Better Capital, Untitled Ventures | 2024 |

FreshToHome | Specializes in delivering fresh meat and seafood quickly. | Fresh, chemical-free products | Delhi-NCR, Mumbai, Pune, etc. | Bangalore, Karnataka | Investcorp, Iron Pillar, Ascent Capital | 2015 |

JioMart | Reliance’s e-commerce platform offering groceries and household essentials. | Wide range of products, integrated with WhatsApp for shopping | 200+ cities (Tier 1 & 2) | Mumbai, Maharashtra | Reliance Industries | 2019 |

Entry of Major Players

Flipkart Minutes has since expanded to major cities including Mumbai, Delhi-NCR, Pune, Kolkata, Chennai, and Hyderabad. This move positions Flipkart as a significant competitor in the quick commerce space, aiming to capture market share from established players.

The pilot aims to deliver grocery and daily essentials within 15 minutes, potentially integrating with Amazon Fresh. This initiative is part of Amazon’s broader strategy to enhance its delivery capabilities and compete with other quick commerce platforms.

Rebranding as ‘Big Quick Commerce’: The rapid expansion and entry of major e-commerce players have led to the sector being referred to as ‘Big Quick Commerce,’ highlighting its growing significance in the retail industry.

10-Minute Food Delivery

Several platforms have introduced 10-minute food and grocery delivery services, catering to urban consumers’ desire for instant gratification.

This ultra-fast delivery model has become a key differentiator in the competitive landscape.

Swiggy Bolt, Zepto Cafe, and Zomato Bistro are leading the charge in the ultra-fast delivery segment in India.

Swiggy Bolt focuses on delivering quick-to-prepare meals from popular restaurants within 10 minutes, ensuring that consumers receive their food hot and fresh.

Zepto Cafe specializes in delivering freshly prepared food items rapidly, leveraging its efficient logistics network to cater to urban consumers’ need for speed.

Zomato Bistro offers a similar promise, providing a curated selection of meals from partner restaurants delivered in under 10 minutes.

Kirana Stores’ Struggles and Survival Response

The proliferation of quick commerce has led to significant financial pressure on kirana stores, especially in urban centers.

Many are struggling to retain market share, with reports indicating that a substantial number have closed due to the inability to compete with the speed, variety, and pricing of quick commerce platforms.

However, to survive, many are adopting strategies such as:

Despite the broader FMCG slowdown, quick commerce has shown remarkable growth and resilience:

The tussle between FMCG brands, distributors, and quick commerce platforms in India has intensified as these platforms, like Blinkit, Zepto, and Instamart, continue to disrupt traditional retail models.

Brands are grappling with high commission fees and deep discounting practices imposed by quick commerce platforms, which erode their profit margins.

Distributors, represented by bodies like the All India Consumer Products Distributors Federation (AICPDF), argue that these platforms create an uneven playing field, threatening the viability of small retailers and traditional distribution networks.

The AICPDF has also raised concerns about potential violations of foreign direct investment (FDI) regulations by these platforms, urging the government to ensure compliance and protect local businesses.

This complex dynamic highlights the challenges of balancing innovation with fair competition and the need for regulatory oversight to maintain market equilibrium.

The Indian FMCG sector in 2025 will be a dynamic interplay of aspiration, affluence, and agility.

Companies must adapt swiftly to evolving consumer demands while balancing premiumization with inclusivity to unlock long-term growth.

The broader trends—health, speed, convenience, and digital transformation—present significant opportunities for innovation, even as challenges like rural demand and margin pressures require strategic navigation.

Indian FMCG is not merely growing; it’s transforming, and the next decade will redefine the playbook for brands aiming to thrive in this competitive landscape.