Over the past five years, India’s online fashion market has witnessed a remarkable annual growth rate of 30%, reaching a staggering value of $11 billion in 2023, according to a global consulting firm

Over the past five years, India’s online fashion market has witnessed a remarkable annual growth rate of 30%, reaching a staggering value of $11 billion in 2023, according to a global consulting firm.

This growth isn’t just driven by traditional retail giants or international brands—it’s increasingly fueled by a new wave of digital-savvy apparel startups such as Bewakoof and The Souled Store that are scaling rapidly without the backing of external capital.

These brands are rewriting the rules of the fashion industry, proving that you don’t need a hefty infusion of venture capital to achieve success.

This blog will explore the remarkable rise of these bootstrapped apparel brands in India, examining how they are navigating the fiercely competitive landscape of the Indian fashion industry, scaling their operations, and achieving substantial growth—all while maintaining complete financial independence.

We will dive deep into the strategic playbook of these brands, uncovering the key factors that contribute to their success.

India’s apparel history is a rich blend of cultural heritage and innovation.

Dating back to ancient times, the Indus Valley Civilization (circa 3300–1300 BCE) provides early evidence of cotton cultivation and sophisticated textile production, highlighting India’s long-standing expertise in fabric and fashion.

By the time of the Maurya and Gupta empires (circa 320 BCE–550 CE), India was renowned for its textiles, exporting fine cotton and silk fabrics across the ancient world.

Post-independence, Indian fashion was characterized by a strong adherence to traditional attire such as the sari for women and the dhoti for men.

However, the late 1980s and 1990s marked a turning point with economic liberalization and the influx of global media, which exposed Indian consumers to Western fashion trends.

This era saw the rise of homegrown brands like Park Avenue, Lakme, and Louis Philippe, which brought a blend of Western and Indian styles to mainstream fashion.

These brands laid the groundwork for the modern Indian fashion industry by introducing ready-made garments and establishing the concept of branded retail stores.

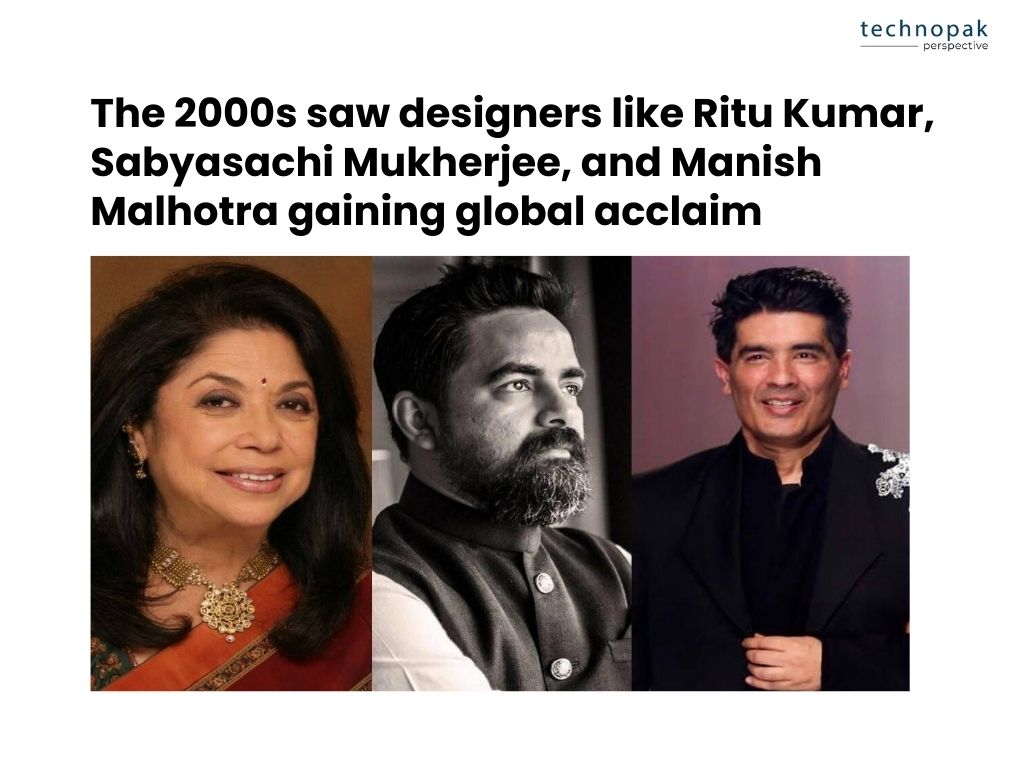

The 2000s witnessed a further evolution, with designers like Manish Malhotra, Sabyasachi Mukherjee, and Ritu Kumar gaining international acclaim.

Their work, which often featured a fusion of traditional Indian craftsmanship and contemporary aesthetics, played a pivotal role in defining India’s fashion narrative on the global stage.

Bollywood’s influence cannot be overstated—costume designers set trends that resonated with the masses, making fashion an integral part of Indian pop culture.

Movies became trendsetters, influencing everything from bridal wear to everyday fashion, thus driving consumer demand for designer labels and branded apparel.

Lean Operations

Lean operations have proven to be a powerful strategy for bootstrapped brands looking to minimize costs and improve efficiency.

The apparel industry typically faces challenges like high inventory costs and excess waste. Implementing lean principles can reduce these costs by up to 40% in some cases.

According to a study by McKinsey, fashion brands that adopted lean management techniques saw a 10% to 20% increase in productivity and a 30% to 50% reduction in production lead times.

Bootstrapped brands are taking a cue from retailers like Zivame, which originally began as an online lingerie seller.

Zivame has successfully implemented lean strategies to streamline their supply chains, resulting in faster turnaround times and lower costs ans ultimate omnichannel pivot.

Direct-to-Consumer (D2C) Model

The D2C model not only cuts out middlemen but also enables brands to capture valuable first-party data directly from their customers.

According to a report by Bain & Company, the D2C channel can be 30% to 50% more profitable than traditional retail models, mainly due to lower distribution costs and direct customer relationships.

An example of a non-venture capital brand leveraging this model is Freakins, a bootstrapped women’s denim brand founded in 2018.

Freakins has effectively used the D2C approach to build its brand with minimal external capital, relying on its own website and social media channels to reach customers directly.

By eliminating traditional retail middlemen,

Freakins not only kept operational costs low but also maintained control over its branding and customer experience.

Through targeted digital marketing and influencer collaborations, the brand quickly built a loyal customer base and scaled profitably.

Similarly, The Souled Store has reported that nearly 90% of its sales come through its own online store, allowing it to maintain higher profit margins and control over customer experience.

These brands highlight how the D2C model can empower businesses to innovate quickly, foster strong customer relationships, and achieve significant growth, proving the immense potential of this approach in the apparel sector.

Social Media Marketing

The power of social media in driving brand growth cannot be overstated.

In India, there are over 500 million active social media users as of 2023, making it a vital channel for reaching potential customers.

Brands that effectively use social media can see up to a 3x increase in customer engagement and sales conversions.

For example, Nykaa, an online beauty and wellness retailer, leverages Instagram and YouTube for product tutorials and reviews, which have significantly contributed to its rapid growth and stellar IPO valuations in 2023.

Additionally, social media advertising spend in India is projected to reach $1.85 billion by 2025, emphasizing its importance for digital-savvy brands.

With over 140 million Instagram users in India as of 2023, brands like The Souled Store and Bewakoof have effectively utilized these platforms to engage with their audience.

For example, Bewakoof, with over 1.5 million followers on Instagram, regularly uses interactive posts, memes, and influencer collaborations to keep its audience engaged. Similarly,

The Souled Store leverages user-generated content and pop culture references to create a strong brand identity that resonates with young consumers.

E-commerce Platforms

The arrival of the internet and digital tools has been a game-changer for the Indian apparel industry, allowing it to transcend geographical limitations and reach a broader audience.

A key component of this channel is E-commerce platforms.

They offer scalable solutions for brands to reach millions of potential customers.

In India, the e-commerce market is expected to surpass $200 billion by 2027, growing at a CAGR of 19%.

Platforms like Amazon India and Flipkart account for a significant share of online apparel sales, providing independently financed brands with an opportunity to tap into a massive customer base without heavy upfront investment in physical retail.

Lenskart, an eyewear brand, expanded its reach significantly by leveraging its online presence, leading to a valuation of over $2.5 billion.

Data Analytics

Data analytics is critical for optimizing inventory management and reducing wastage, which is a significant issue in the apparel industry, where unsold inventory can account for up to 30% of a brand’s total stock.

By using data analytics, brands can achieve a 20% reduction in inventory costs and a 15% improvement in forecasting accuracy.

For instance, Myntra uses data analytics to offer personalized product recommendations, which has helped increase its conversion rates by 35%.

AI and Machine Learning

The use of AI and machine learning in the fashion industry is transforming how brands operate and engage with customers.

A study by PwC found that AI can increase business productivity by up to 40%. Zara, the global fast-fashion brand, uses AI to manage its inventory and supply chain, reducing time-to-market from design to store in as little as 10-15 days.

Indian brands are catching up, with companies like Ajio using AI-driven personalization engines to recommend outfits based on customer browsing history, significantly boosting sales and customer satisfaction.

The COVID-19 pandemic accelerated the shift towards digital platforms, with many consumers preferring online shopping due to safety concerns.

This led to a surge in digital innovations such as virtual try-on features, augmented reality (AR) fitting rooms, and enhanced online customer service.

Brands like FabAlley have introduced AI-driven chatbots to provide personalized shopping experiences, answering queries and suggesting products based on browsing history.

Automation

Automation in the apparel industry can reduce manual effort and minimize errors.

By automating processes such as order fulfillment and inventory updates, brands can achieve a 25% to 50% reduction in operational costs.

For example, Chumbak, an Indian lifestyle brand, uses automation tools to manage its online store operations, allowing it to handle a high volume of orders efficiently and reduce the dependency on human intervention.

Automation also enables brands to scale rapidly without proportionally increasing labor costs.

For bootstrapped apparel brands, carving out a strong brand identity is not just a marketing strategy—it’s a survival tool.

Without the cushion of venture capital funding, these brands rely heavily on organic growth to scale their businesses.

A compelling brand identity enables them to differentiate themselves in a saturated market, create an emotional connection with customers, and build a loyal following.

This connection can translate into repeat purchases, word-of-mouth marketing, and customer advocacy, all of which are critical for sustained growth without the need for external funding.

A well-defined brand identity goes beyond logos and slogans; it encapsulates the brand’s personality, voice, and values that resonate with the target audience.

For bootstrapped brands, this authenticity can set them apart from larger, well-funded competitors.

By focusing on authentic storytelling, personalized customer engagement, and strategic influencer collaborations, these brands can create a memorable and lasting presence in the minds of consumers.

This organic approach not only attracts customers but also turns them into brand ambassadors, driving growth without the need for hefty marketing budgets.

The Souled Store: This Indian brand has built a strong identity by focusing on pop culture-inspired merchandise, including apparel, accessories, and more.

Their storytelling revolves around a passion for pop culture and a commitment to offering officially licensed merchandise, which resonates deeply with their target audience of millennials and Gen Z.

By sharing stories about their collaborations with franchises like Marvel, DC Comics, and Harry Potter, The Souled Store connects emotionally with fans of these genres.

They also highlight their journey as a homegrown brand, creating a sense of pride and ownership among their Indian customer base.

This authentic storytelling has helped The Souled Store carve out a niche market, fostering loyalty and differentiating itself in a highly competitive industry.

Suta: Known for its sustainable and ethically-made sarees, Suta uses storytelling to highlight its commitment to supporting traditional Indian artisans.

The brand regularly shares stories about the weavers who create their products, detailing their craftsmanship and the cultural significance of their work.

By showcasing these narratives on their website and social media platforms, Suta builds an emotional connection with its customers, who feel they are part of preserving India’s rich textile heritage.

This storytelling approach not only boosts customer loyalty but also allows Suta to command premium pricing, as customers perceive the brand’s products as unique and valuable.

Nykaa: Starting as a bootstrapped online beauty retailer, Nykaa has grown into a massive beauty and cosmetics platform in India.

Of course, now it is well funded and venture capital backed.

But this was not always the case.

Nykaa’s customer engagement strategy included and continues to be centred on personalized recommendations, interactive social media campaigns, and user-generated content.

For example, Nykaa’s YouTube channel and Instagram handle regularly feature makeup tutorials, product demos, and beauty tips, encouraging customer interaction and feedback.

Nykaa also leverages its customer data to send personalized email and app notifications about new product launches and exclusive offers, which helps in driving repeat purchases.

Their loyalty program, Nykaa Prive, offers members exclusive access to sales, special events, and early product releases, further enhancing customer retention and engagement.

Chumbak: An Indian lifestyle brand known for its quirky and colorful designs, Chumbak actively engages with its customers through social media platforms.

Chumbak started as a bootstrapped brand. It was founded in 2010 by Vivek Prabhakar and Shubhra Chadda, who initially funded the business with their own savings.

Over time, Chumbak has grown significantly and has received external funding to support its expansion.

They encourage customers to share photos of their Chumbak products using specific hashtags, which are then featured on the brand’s official pages.

This user-generated content not only provides Chumbak with authentic marketing material but also fosters a sense of community among their customers.

Chumbak also uses Instagram Stories to conduct polls, quizzes, and behind-the-scenes looks, making their audience feel involved in the brand’s creative process.

Such initiatives keep customers engaged, build a loyal community, and drive organic growth.

Freakins: This denim-focused fashion brand has successfully leveraged micro-influencers to reach its target audience of young, fashion-conscious women.

By collaborating with influencers who have a strong following in the fashion space, Freakins ensures that its products are seen by a relevant and engaged audience.

These influencers often create styled looks using Freakins products, share discount codes, and provide reviews, which helps drive traffic to the brand’s online store and increase sales.

The authenticity and relatability of micro-influencers make their recommendations more trustworthy, leading to higher conversion rates and brand loyalty.

While online channels like Instagram have helped apparel brands gain prominence, the lack of external capital has resulted in a slower pace of growth but in a more profitable manner.

Here is the journey of Indian new-age apparel brands who are going it alone.

These brands have benefited from the premiumization of products and growing disposable incomes as Gen Z and millennials spend more readily on niche and specific categories.

Suta: When ethnic brand Suta began selling dresses and skirts eight years ago, founders Sujata and Taniya Biswas could hardly imagine building a ₹75 crore business without any venture capital.

With about 55% customer retention, Suta earns a little more than half of its revenue from its website and other social media applications.

It also gets a significant chunk of its income from online marketplaces like Myntra, while its offline stores contribute to the remaining.

Over the years, the company has added several other offerings that include sarees, blouses, menswear, and accessories.

Mulmul: Similarly, Mulmul, another premium brand that sells ethnic wear, including suits, sarees, and designer wear, has bootstrapped its way to the ₹100 crore revenue mark over a five-year span.

Run by third-generation textile entrepreneur Harsh Modi, who previously produced material for international brands such as Zara and H&M, the company gets about 80% of its orders from metro cities. In the initial days,

Mulmul gained traction through influencer marketing and social media platforms such as Instagram, which contributed to the bulk of its revenues.

However, much like Suta, Mulmul has been focusing heavily on offline presence and eventually plans to venture into markets beyond the metros.

Phutari: Other small-scale brands like Jaipur-based Phutari, which clocks about ₹2 crore in revenues per year, have also made similar moves to capitalize on the growing online consumer base.

The four-year-old company gets 90% of its income from Instagram and has seen its average order value grow by about 40% to ₹3,500.

While the company is still in its early days, it plans to roll out its first offline store in January, founder Rohan Malhotra has stated.

Bewakoof: Bewakoof, founded in 2012 by Prabhkiran Singh and Siddharth Munot, has quickly become a household name in India’s casual wear segment, especially among the youth.

The brand is recognized for its quirky, relatable, and humorous designs, which often feature witty slogans and pop culture references.

Bewakoof has mastered the art of leveraging social media, using platforms like Instagram and Facebook to engage directly with its audience and create a strong community of followers.

By maintaining lean operations, focusing on high-margin products, and utilizing a direct-to-consumer (D2C) model, Bewakoof has scaled its business significantly.

The company’s approach to staying relevant through limited edition releases and collaborations with popular franchises like Marvel and DC Comics has further fueled its growth and popularity.

While Bewakoof started with minimal capital, it has received external funding over the years to support its expansion.

The Souled Store: Launched in 2013 by Vedang Patel, Aditya Sharma, and Sahil Mohan Gupta

The Souled Store has carved a niche for itself with its pop culture-themed merchandise, including apparel, accessories, and collectibles.

Known for its vibrant and creative designs inspired by popular TV shows, movies, and music, the brand has built a loyal customer base that resonates with its unique offerings.

The Souled Store excels at creating engaging content and campaigns on social media, which not only drives sales but also fosters a strong brand community.

The brand has also leveraged partnerships with major e-commerce platforms like Flipkart and Myntra to expand its reach.

Despite fierce competition in the apparel market, The Souled Store’s focus on quality, customer service, and strategic product placement has enabled it to grow profitably with minimal need for venture capital.

StalkBuyLove: Since its inception, StalkBuyLove has made a name for itself in the fast-fashion sector, focusing on trendy and stylish women’s apparel.

The brand draws inspiration from global fashion trends and adapts them to the preferences of Indian consumers, offering a wide range of clothing that combines style with affordability.

StalkBuyLove has successfully used social media platforms and influencer marketing to create buzz around its products, regularly collaborating with fashion bloggers and influencers to showcase its latest collections.

By keeping a tight grip on its supply chain and using data analytics to forecast demand and manage inventory, StalkBuyLove has managed to sustain its growth trajectory without solely relying on external funding.

Its strategy of frequent new launches and limited-edition collections keeps customers engaged and coming back for more.

FabAlley: Co-founded by Shivani Poddar and Tanvi Malik, FabAlley has become a prominent player in India’s online fashion landscape by offering chic, contemporary, and affordable fashion for women.

The brand uses a data-driven approach to understand consumer behavior and preferences, enabling it to design products that resonate well with its target audience.

FabAlley’s emphasis on direct-to-consumer sales through its own website and robust social media presence has allowed it to maintain control over its brand identity and customer experience.

The brand’s commitment to quality, style, and customer satisfaction has led to a steady increase in its customer base.

By focusing on digital-first strategies and agile production processes, FabAlley has managed to scale effectively and profitably, all while remaining bootstrapped.

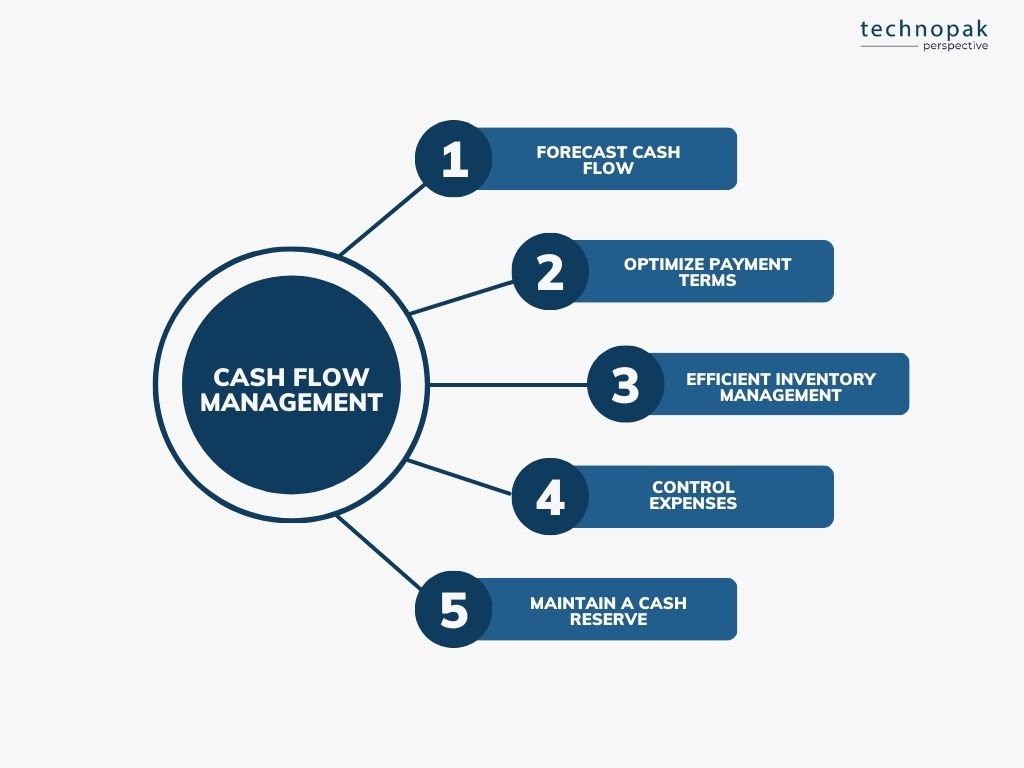

Effective cash flow management is crucial for bootstrapped apparel brands to ensure smooth operations and sustainable growth.

Here are some tips:

Brands like Zivame have successfully optimized cash flow by negotiating 30-60 day payment terms with suppliers, allowing them to manage cash better and reduce financial strain.

Bewakoof, for instance, uses a data-driven approach to keep its inventory lean and agile, ensuring that they do not tie up excessive capital in unsold stock.

Brands such as The Souled Store limit expenditure on traditional advertising by focusing heavily on digital marketing, which is more cost-effective and measurable.

This practice has helped brands like FabAlley to navigate economic downturns without the need to secure external funding.

Sustainability is becoming increasingly important in the apparel industry, with consumers and brands alike prioritizing eco-friendly practices.

Here’s how some Indian brands are incorporating sustainability:

This not only appeals to environmentally conscious consumers but also reduces dependency on conventional raw materials, lowering costs in the long run.

By focusing on ethical production, brands can attract consumers who prioritize social responsibility and are willing to pay a premium for ethically made products.

Doodlage integrates upcycling into its design process, turning factory waste into fashionable garments, thus minimizing waste and costs associated with raw materials.

These initiatives provide financial incentives and support for brands to invest in sustainable technologies and practices.

Reinvesting profits back into the business is essential for growth and innovation.

Here’s why it’s important:

Chumbak, a lifestyle brand, reinvests its earnings to continuously expand its product range, which keeps the brand fresh and relevant.

By reinvesting in advanced e-commerce technologies, brands like Clovia have enhanced their customer experience, leading to higher conversion rates and customer satisfaction.

The Souled Store has consistently reinvested in its design capabilities and product development, ensuring its offerings remain aligned with pop culture trends, keeping its audience engaged.

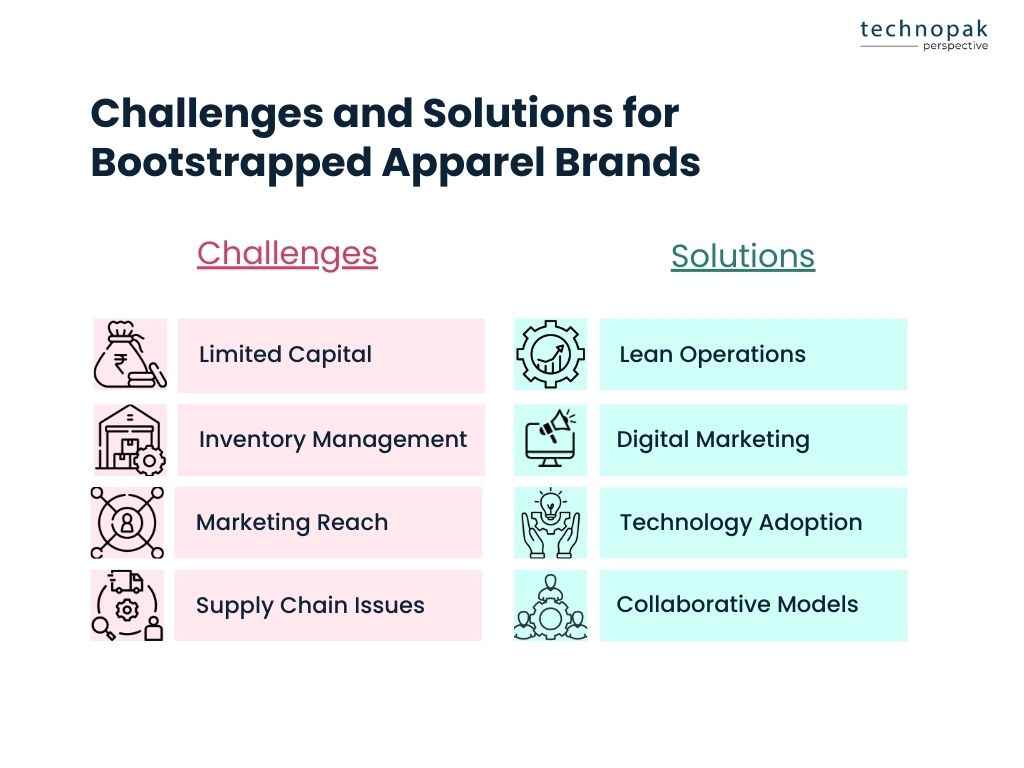

Bootstrapped apparel brands face several challenges, including:

Brands often have to be creative in their funding strategies, relying heavily on profits and minimal debt.

Overstocking ties up capital, while understocking can lead to lost sales.

Without large marketing budgets, bootstrapped brands need to be highly strategic in their approach.

Brands need to establish strong relationships with suppliers and have contingency plans in place.

Despite these challenges, many brands have found innovative solutions:

This includes everything from manufacturing to marketing strategies, focusing on what delivers the best ROI.

Their digital-first approach enables them to engage with customers directly, build brand loyalty, and drive sales without large-scale advertising costs.

Brands like Bewakoof leverage AI to understand consumer behavior, allowing for precise targeting and reduced marketing spend.

This not only appeals to consumers who value sustainability but also helps in building strong community ties, which can provide both marketing and operational benefits.

The future for digital-savvy apparel brands in India looks promising.

The Indian fashion market is projected to grow to $106 billion by 2026, driven by increasing internet penetration and a growing middle class.

With the rise of conscious consumerism, brands that prioritize sustainability and ethical practices are likely to gain a competitive edge.

According to a report by McKinsey, 67% of consumers consider the use of sustainable materials to be an important purchasing factor.

Technological advancements will continue to play a crucial role in the growth of these brands.

The adoption of AI and machine learning for personalized shopping experiences, predictive analytics for inventory management, and automation for operational efficiency will become even more prevalent.

The global AI in retail market is expected to reach $23.32 billion by 2027, highlighting the significant impact of technology on the industry.

Moreover, the shift towards omnichannel strategies will enable brands to create seamless shopping experiences, combining the convenience of online shopping with the tactile experience of physical stores.

This approach will be particularly important in tapping into tier 2 and 3 markets, where consumers are increasingly looking for trust and transparency in their shopping experiences.

Technopak can help you navigate the complexities of the market and achieve sustainable growth.

We have helped thousands of clients realize their business potential with tailored strategies.

Reach out to us to learn more about how we can support your journey to success