Health consciousness is on the rise, and with it, the demand for healthy packaged foods.

The nutritional food market was valued at USD 5.93 billion in 2022 and is projected to reach USD 12.63 billion by 2030, following a CAGR of 9.9%, according to Data Bridge Market Research.

Health consciousness is on the rise, and with it, the demand for healthy packaged foods.

The nutritional food market was valued at USD 5.93 billion in 2022 and is projected to reach USD 12.63 billion by 2030, following a CAGR of 9.9%, according to Data Bridge Market Research.

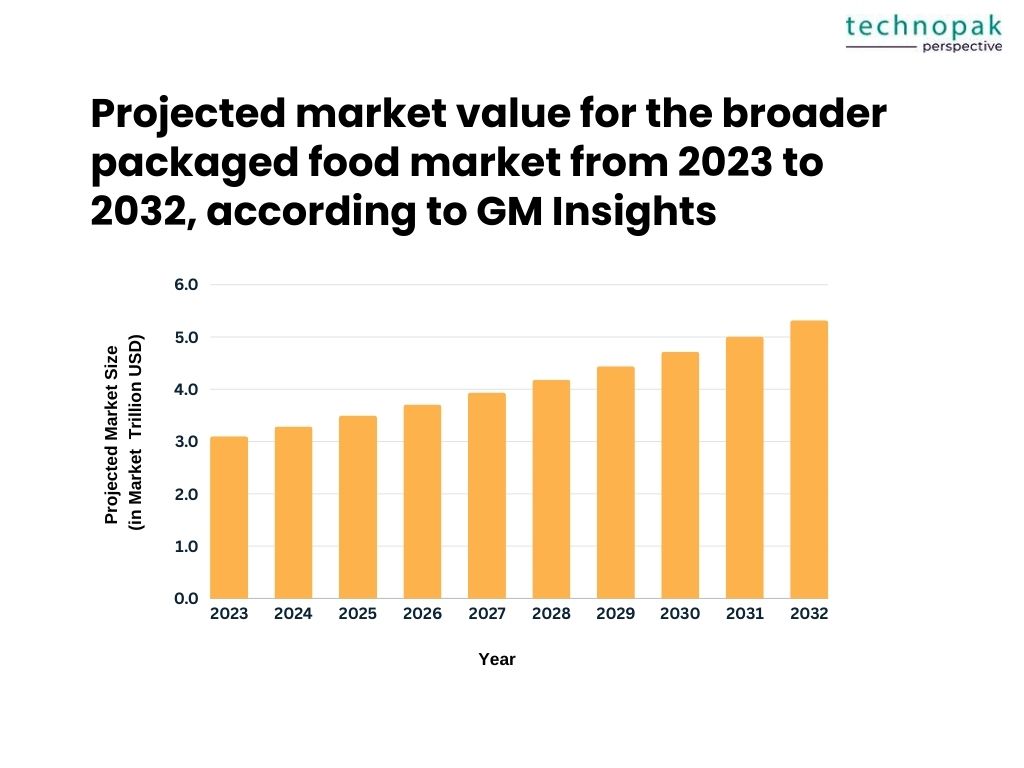

The broader packaged food market size was valued at around USD 3.1 trillion in 2023 and is estimated to reach USD 5.32 trillion by 2032 as per GM Insights.

This blog post delves into the transformative journey of India’s packaged food industry, exploring the burgeoning trend of health-centric products and what it heralds for consumers and manufacturers alike.

The Health wave in Indian consumerism is a profound shift that reflects the changing priorities and values of a nation on the move.

As India continues to urbanize at a rapid pace, the lifestyle and dietary habits of its people are evolving.

The rise in disposable incomes has given consumers the means to make more deliberate food choices, prioritizing health and wellness over mere sustenance.

With the number of health-conscious consumers projected to rise in a 6 year period from 108 million in 2020 to 176 million by 2026, the demand for healthier food options is not just a fad but a fundamental shift in consumption patterns.

Organized retail and e-commerce have made it easier for consumers to access a wide array of health-focused products.

Supermarkets and online platforms are expanding their offerings to include organic, natural, and fortified foods, catering to the growing demand.

This accessibility has been a significant factor in the shift towards health-conscious consumption.

The pandemic has further accelerated this trend, creating what has been described as ‘the biggest seismic shift’ in consumer behaviour, with health and immunity taking centre stage.

The EY Future Consumer Index reports that around 94% of Indians are concerned about their family’s health, which is higher than the global average of 82%.

This concern has translated into action, with Indian consumers willing to spend more on fitness classes, natural foods, health supplements, and specialized diets.

Moreover, there’s a growing preference for “better for you” foods and home remedies, with Ayurveda and herbal products increasingly becoming the ‘back to roots’ answers to modern problems.

The dietary supplements market in India, which has always been considered high potential given the growing lifestyle diseases, has witnessed an accelerated adoption curve, with a demand growth of over 25% for herbal supplements and vitamins and minerals, according to IMARC.

This transformation in consumer behaviour is not just a fleeting change but a permanent alteration in the landscape of Indian consumerism.

It’s a movement that’s expected to continue growing, driven by a collective desire for a healthier, more sustainable way of living.

The Indian consumer is no longer passive but actively engaged in making choices that align with their health goals, signalling a new era of informed and health-conscious consumerism.

Factors such as urbanization, rising disposable incomes, and the proliferation of organized retail have contributed to a more health-conscious society.

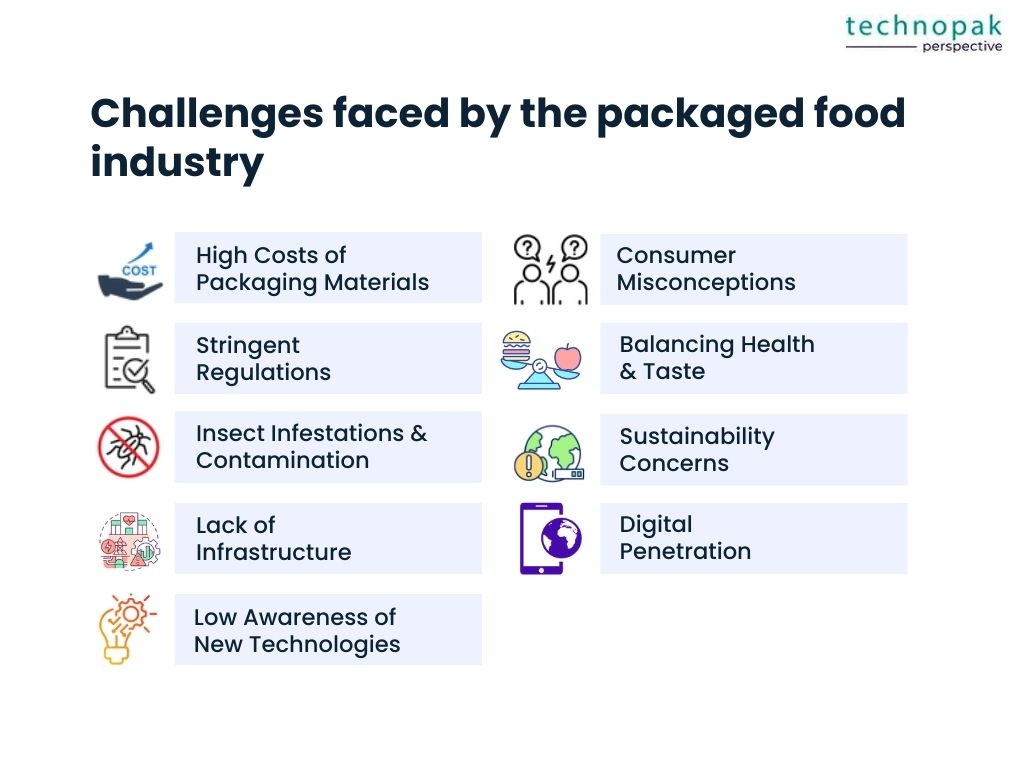

Despite the growing demand, the packaged food industry faces hurdles in aligning with health-conscious demands.

Misconceptions about the healthiness of packaged foods persist, and the industry grapples with balancing convenience, taste, and nutrition.

High costs associated with packaging materials, stringent regulations, and a lack of infrastructure are some of the challenges that manufacturers encounter.

Here’s a point-wise elaboration on the challenges faced by the packaged food industry:

These challenges require strategic planning, investment in technology, and continuous innovation to ensure that the packaged food industry can meet the evolving demands of the health-conscious Indian consumer.

The Health wave in Indian consumerism is a profound shift that reflects the changing priorities and values of a nation on the move.

As India continues to urbanize at a rapid pace, the lifestyle and dietary habits of its people are evolving.

The rise in disposable incomes has given consumers the means to make more deliberate food choices, prioritizing health and wellness over mere sustenance.

With the number of health-conscious consumers projected to rise in a 6 year period from 108 million in 2020 to 176 million by 2026, the demand for healthier food options is not just a fad but a fundamental shift in consumption patterns.

Organized retail and e-commerce have made it easier for consumers to access a wide array of health-focused products.

Supermarkets and online platforms are expanding their offerings to include organic, natural, and fortified foods, catering to the growing demand.

This accessibility has been a significant factor in the shift towards health-conscious consumption.

The pandemic has further accelerated this trend, creating what has been described as ‘the biggest seismic shift’ in consumer behaviour, with health and immunity taking centre stage.

The EY Future Consumer Index reports that around 94% of Indians are concerned about their family’s health, which is higher than the global average of 82%.

This concern has translated into action, with Indian consumers willing to spend more on fitness classes, natural foods, health supplements, and specialized diets.

Moreover, there’s a growing preference for “better for you” foods and home remedies, with Ayurveda and herbal products increasingly becoming the ‘back to roots’ answers to modern problems.

The dietary supplements market in India, which has always been considered high potential given the growing lifestyle diseases, has witnessed an accelerated adoption curve, with a demand growth of over 25% for herbal supplements and vitamins and minerals, according to IMARC.

This transformation in consumer behaviour is not just a fleeting change but a permanent alteration in the landscape of Indian consumerism.

It’s a movement that’s expected to continue growing, driven by a collective desire for a healthier, more sustainable way of living.

The Indian consumer is no longer passive but actively engaged in making choices that align with their health goals, signalling a new era of informed and health-conscious consumerism.

Factors such as urbanization, rising disposable incomes, and the proliferation of organized retail have contributed to a more health-conscious society.

The market has witnessed a surge of innovative healthy packaged food products in the recent past.

Brands are now adopting sustainable practices, using healthier ingredients, and fortifying consumables to meet the nutritional needs of consumers.

This innovation is not just a response to consumer demand but a commitment to the well-being of society.

Some notable innovation trends in the healthy packaged foods include:

Surge of Health-Focused Products: The market has seen an influx of innovative products aimed at health-conscious consumers. This includes snacks with reduced fat content, sugar-free options, and foods enriched with vitamins and minerals.

Sustainable Practices: Brands are increasingly adopting eco-friendly practices, from sourcing ingredients sustainably to using biodegradable packaging, reflecting a broader commitment to environmental stewardship.

Healthier Ingredients: There’s a shift towards using ingredients that offer greater health benefits, such as whole grains, superfoods, and natural sweeteners, to cater to the nutritional needs of consumers.

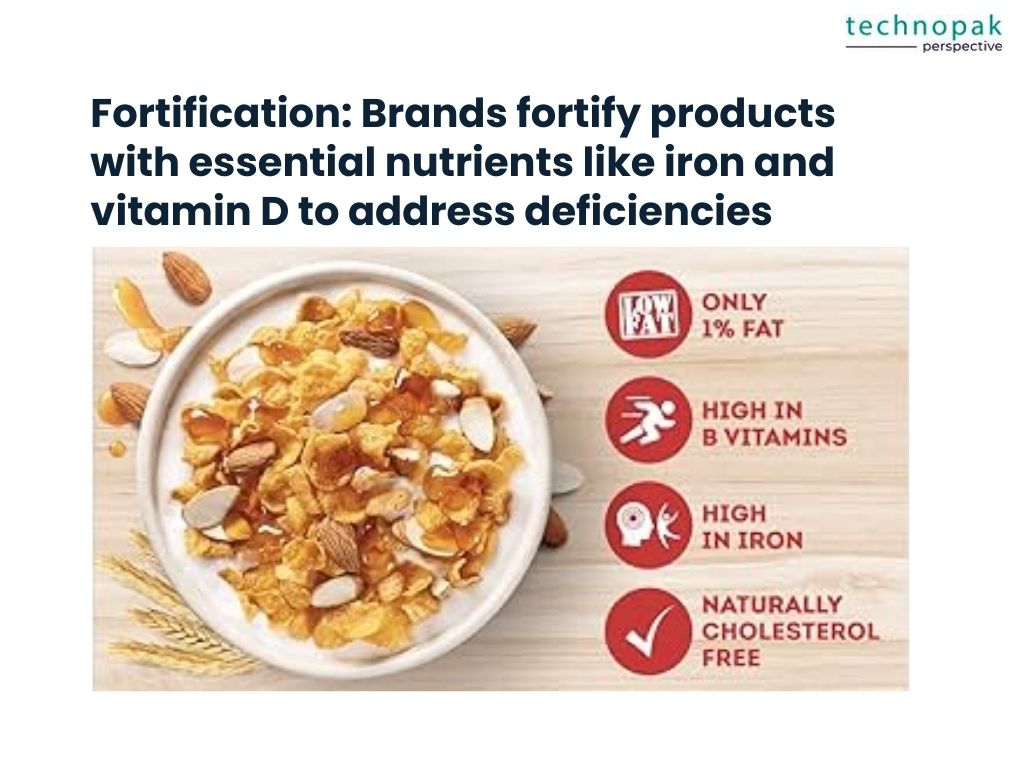

Fortification of Foods: To combat nutritional deficiencies, many brands are fortifying their products with essential nutrients like iron, iodine, and vitamin D, making it easier for consumers to meet their daily requirements.

Transparency in Labelling: Detailed labelling has become a significant focus, with brands providing comprehensive information about the nutritional content and health benefits of their products.

Plant-Based Alternatives: The rise of veganism and vegetarianism in India has spurred the growth of plant-based alternatives, offering consumers a variety of options that align with their dietary preferences.

Functional Foods: There’s a growing interest in functional foods that provide health benefits beyond basic nutrition, such as immune-boosting properties or digestive health support.

Catering to Lifestyle Diets: Brands are also catering to specific lifestyle diets, such as keto, paleo, and gluten-free, ensuring that there’s something for everyone.

Innovative Startups: A number of startups have entered the market, bringing fresh perspectives and novel products that challenge traditional notions of packaged foods.

Consumer Education: Companies are investing in educating consumers about the benefits of healthy eating, which in turn drives demand for nutritious packaged foods.

This innovation in healthy packaged foods is not merely a business response to a growing market segment but a reflection of a deeper societal commitment to promoting well-being and sustainability.

It represents a holistic approach to food production and consumption, where the health of individuals and the planet are given paramount importance.

The availability of healthier packaged foods is reshaping consumer behaviour.

Detailed labels and transparent packaging influence purchasing decisions, while social media and influencers play a pivotal role in promoting healthy eating habits.

Consumers are increasingly making informed choices, seeking foods with high nutritional value and immunity-boosting properties.

Here’s a detailed elaboration on the packaged food trends with regard to consumer behaviour:

This shift towards healthier packaged foods is not just a passing trend but a reflection of a deeper societal change towards health and wellness.

As consumers continue to demand more from the products they consume, the industry is expected to evolve, offering even more options that cater to this growing health wave.

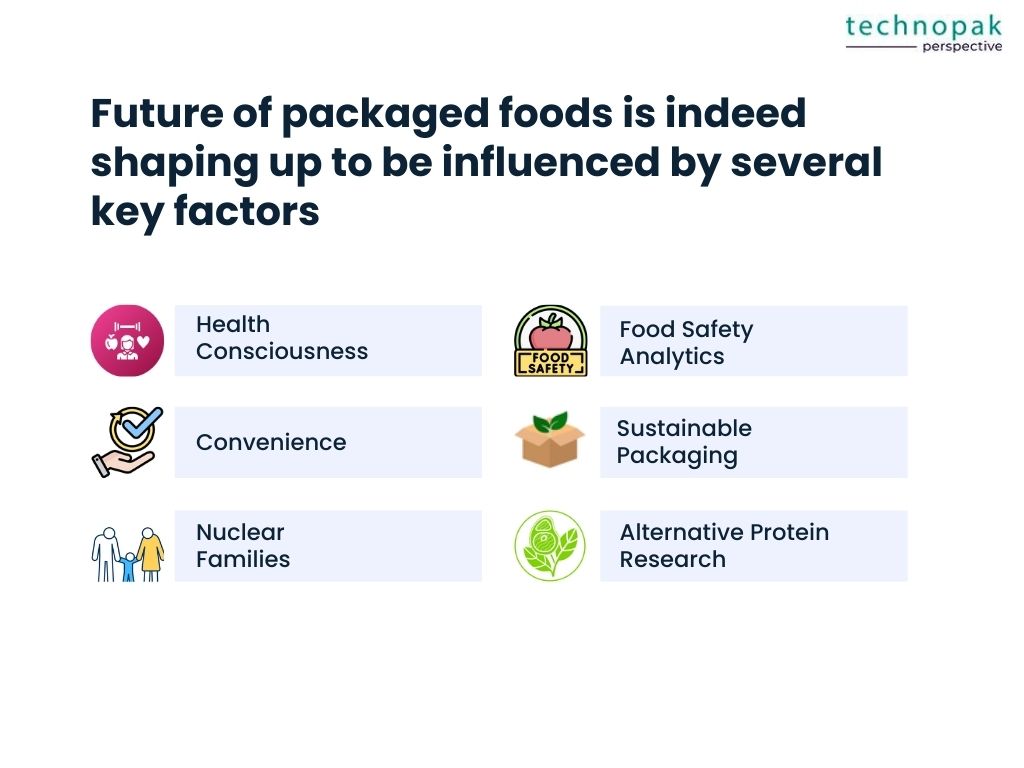

Looking ahead, the packaged food industry is poised for a health-driven transformation.

Trends indicate a rise in health consciousness among consumers, an increasing demand for convenience, and a growing number of nuclear families leading to a surge in ready-to-eat meals.

The future is likely to see a higher demand for roles in food safety analytics, sustainable packaging solutions, and alternative protein research.

In the Indian context, the future of packaged foods is indeed shaping up to be influenced by several key factors:

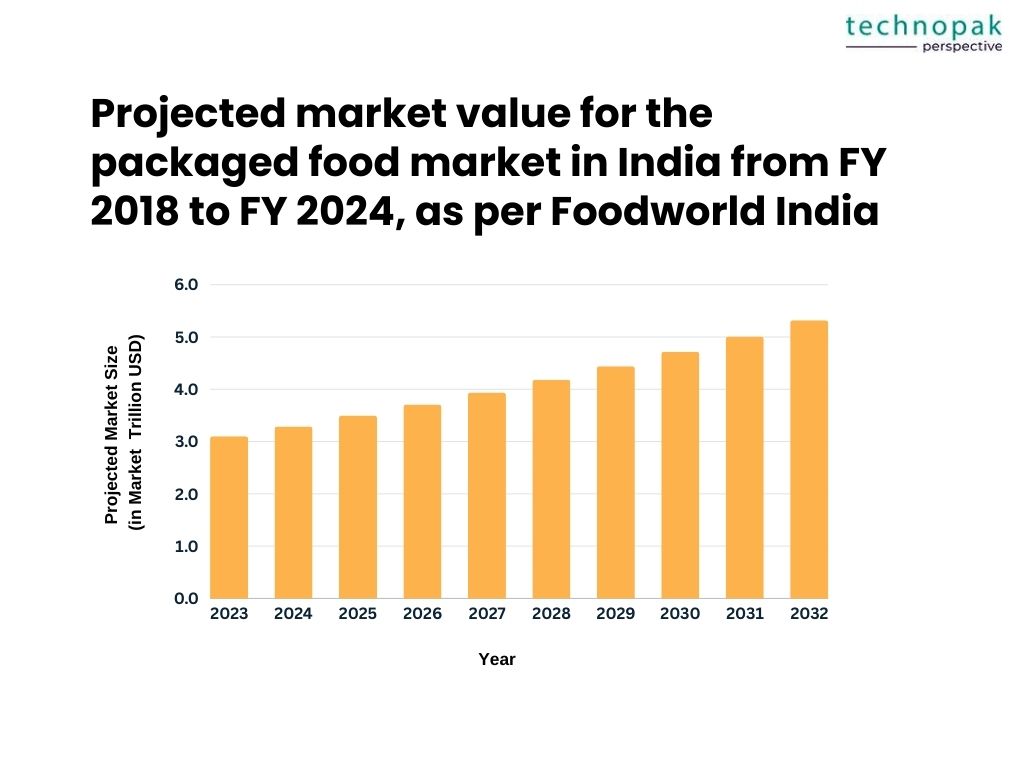

The packaged food market in India was valued at Rs 25,691.30 billion in FY 2018 and reached Rs 53,435.52 billion by the end of FY 2024 (March 2024), expanding at a CAGR of 12.09% during the FY 2020-24 period.

This growth is driven by the factors mentioned above, along with digital commerce, which has doubled during the pandemic, and the government’s push towards health and nutrition.

FSSAI’s Proactive Measures in Curbing Food Safety Violations

The Food Safety and Standards Authority of India (FSSAI) is the sentinel of food safety, tasked with protecting and promoting public health through the regulation and supervision of food safety.

FSSAI’s mandate encompasses setting standards for food products, regulating their manufacture, storage, distribution, sale, and import to ensure that safe and wholesome food is available for human consumption.

FSSAI’s Vigilance and Enforcement

In recent times, FSSAI has intensified its vigilance and enforcement actions to curb food safety violations by packaged food companies.

A notable instance is the initiation of 1,411 prosecution cases against Food Business Operators (FBOs) found violating food safety laws since April 2023.

This demonstrates FSSAI’s commitment to stringent enforcement of food safety regulations.

Blinkit Warehouse Inspection

Another stark example of FSSAI’s proactive approach is the inspection of a Blinkit warehouse in Telangana’s Medchal-Malkajgiri district.

The inspection revealed significant violations of food handling and storage regulations, leading to the seizure of infested and improperly stored products.

This action underscores the authority’s dedication to ensuring compliance with food safety norms.

Spice Sector Under Scrutiny

The spice sector has also come under FSSAI’s scanner, especially after the suspension of some spices from Everest and MDH by Singapore and Hong Kong due to high levels of carcinogenic substances.

This prompted FSSAI to test samples from these brands, ensuring that Indian spices meet global safety standards.

FSSAI’s Impact on Major Brands

FSSAI’s stringent measures have a profound impact on major brands. For instance, Nestle faced scrutiny from FSSAI over the sugar content in their baby food products.

Such actions compel brands to adhere to food safety norms and foster a culture of compliance and responsibility towards consumer health.

Enhanced Consumer Protection

FSSAI’s measures significantly enhance consumer protection by ensuring that food products in the market are safe to consume.

The authority’s actions help in upholding the quality of food products, thereby safeguarding public health and consumer interests.

Future Outlook

Looking ahead, FSSAI’s ongoing commitment to stringent food safety standards is expected to have a lasting impact on the industry.

With continuous monitoring and enforcement, FSSAI aims to elevate India’s food safety ecosystem, ensuring that it remains robust, transparent, and consumer-centric.

FSSAI’s proactive measures are pivotal in maintaining the integrity of India’s food supply chain.

By enforcing food safety laws and holding FBOs accountable, FSSAI not only protects consumers but also enhances the reputation of India’s food industry on a global scale.

The narrative of India’s packaged food industry is one of change and adaptation.

As we unpack the layers of this evolution, the significance of the shift towards nutritious packaged foods becomes clear.

It is a movement that promises better health for consumers and a sustainable future for manufacturers.

Are you a packaged food business looking to scale with winning strategies?

Get in touch today for tailor made strategies for your packaged food business.

Seamlessly navigate the regulatory environment as we help your business take wings through sustainable strategies.