The world of social media is going paws-itively wild for pet influencers, and India is no exception.

The kids’ consumer market in India is witnessing significant growth, propelled by modern parents’ inclination towards high-quality, safe, and innovative products.

From educational toys and sustainable clothing to organic snacks and hygiene essentials, brands are expanding their offerings to meet this escalating demand.

According to IMARC Group, the Indian kids’ apparel market reached $22.1 billion in 2024 and is projected to reach $27.1 billion by 2033, exhibiting a CAGR of 2.17% during 2025-2033.

Similarly, Grand View Research reports that the global toys and games market was valued at $324.66 billion in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030.

This surge is fueled by factors such as the expansion of e-commerce, the influence of digital entertainment, and a rising middle-class population.

Let’s delve into the elements shaping this rapidly growing sector.

The burgeoning kids’ consumer market in India is driven by several key factors that reflect changing societal trends and economic growth.

Modern Indian parents are increasingly prioritizing products that support their children’s development, safety, and well-being.

This shift is evident in the rising demand for educational and STEM-based toys that promote cognitive and motor skills.

Brands like Smartivity offer a range of wooden educational toys designed to enhance brain development and creativity. Similarly, Flintobox provides STEM-based activity boxes that encourage learning through play.

In addition to educational value, there’s a growing preference for products made from organic, chemical-free, and non-toxic materials. Parents are choosing items that ensure safety and promote health.

For instance, Sortin offers a selection of planet-friendly baby and kids’ products, including non-toxic toys and biodegradable diapers, catering to environmentally conscious parents.

The proliferation of e-commerce platforms has made accessing children’s products more convenient than ever.

Established in 2010, FirstCry has become India’s largest online store for newborn, baby, and kids’ products, offering a vast range from diapers to strollers.

Similarly, Hopscotch provides exclusive baby and kids’ products from around the world, demonstrating consistent business growth.

Primarily known for online fashion, Myntra has expanded to include an exclusive kids’ range, offering both international and local brands.

Major e-commerce platforms Amazon and Flipkart have dedicated sections for children’s products, enhancing accessibility for parents nationwide.

Additionally, quick-commerce apps like Zepto and Blinkit enable parents to purchase essentials instantly, making impulse shopping a significant factor in rising sales.

The growing popularity of animated characters and digital influencers has led to a surge in IP-based merchandise sales.

For example, characters like Peppa Pig and franchises such as Marvel have inspired a wide range of licensed products, from clothing lines to school supplies, allowing children to connect with their favorite characters beyond the screen.

Jewelry brands like CaratLane have also introduced collections featuring popular animated figures, catering to this trend.

In celebration of Raksha Bandhan, CaratLane launched a Disney-inspired jewelry collection featuring over 80 designs that showcase characters from Disney’s Mickey and Friends, Winnie the Pooh, Disney Frozen, and Disney Princess franchises.

This collection appeals to young teens and women, blending cherished stories with wearable art.

Additionally, CaratLane introduced a jewelry line inspired by the popular Japanese cartoon character Doraemon.

This collection includes a range of rings, bracelets, earrings, and pendants, each featuring different characters from the beloved anime.

The launch was well-received, generating significant engagement on social media platforms.

These initiatives exemplify how brands are leveraging the popularity of animated characters to create products that resonate with both children and adults, thereby expanding their market reach.

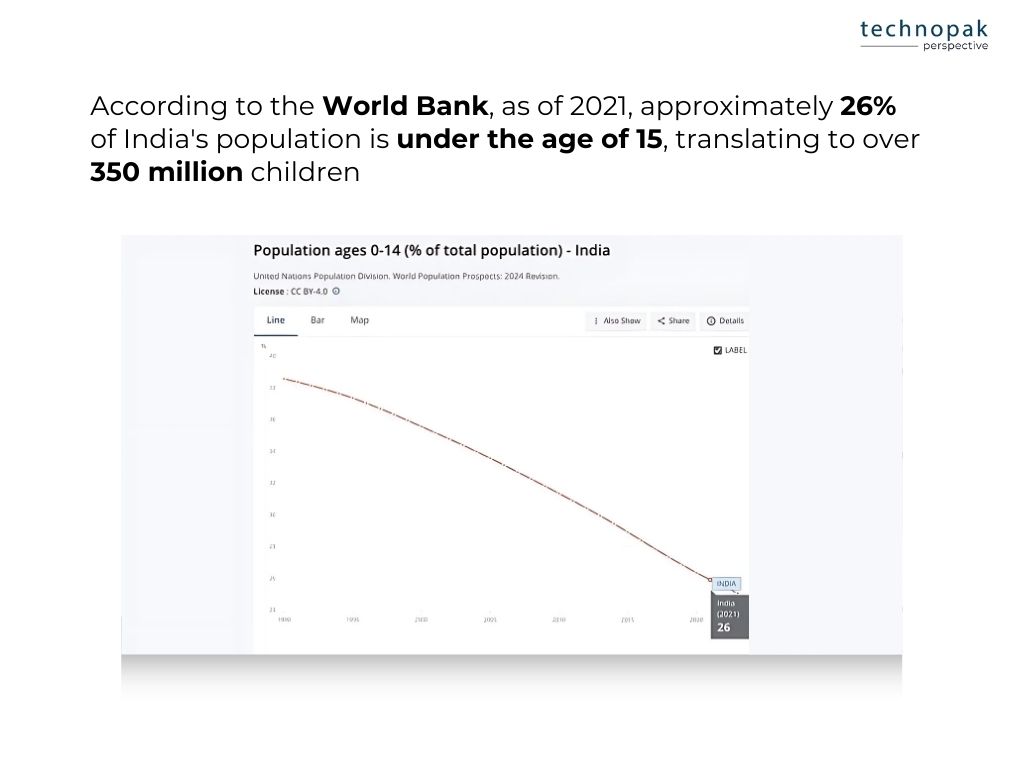

India’s substantial youth population presents a significant market for children’s products. According to the World Bank, as of 2021, approximately 26% of India’s population is under the age of 15, translating to over 350 million children.

This young demographic, coupled with an expanding middle class and rising disposable incomes, allows parents to invest more in quality brands, leading to a consistent increase in demand across various categories.

These factors collectively contribute to the dynamic growth of the kids’ consumer market in India, reflecting evolving consumer behaviors and economic advancements.

The Indian kids’ consumer market is experiencing significant growth across various segments, each contributing uniquely to this upward trend.

STEM-based toys are educational toys designed to teach children concepts in Science, Technology, Engineering, and Mathematics (STEM) through hands-on play.

These toys encourage problem-solving, creativity, and logical thinking by allowing kids to build, experiment, and explore real-world applications of scientific principles.

Examples include robotics kits that introduce coding, magnetic building blocks that teach structural engineering, and science experiment sets that demonstrate chemical reactions.

Popular Indian brands like Smartivity and Skillmatics offer engaging STEM toys that help children develop critical thinking skills while having fun, making them an increasingly preferred choice among parents who prioritize learning-based play.

The global STEM toy market is also witnessing a boom, as parents actively seek early childhood learning solutions to foster their children’s cognitive development.

The kids’ apparel and fashion sector is witnessing remarkable growth, with startups like Includ leading the charge.

Includ has achieved an annualized revenue of ₹72 crore in under two years, highlighting the significant spending on children’s apparel in many Indian households.

Additionally, brands such as Gini & Jony, established in 1980, have become prominent players in the Indian kids’ fashion industry, offering a wide range of clothing options that cater to contemporary tastes.

Online retailers have also played a pivotal role in this expansion. Platforms like Myntra have reported substantial growth in their kids’ categories. For instance, during their ‘Big Fashion Days’ sale, Myntra witnessed the sale of 2.2 lakh units in kids’ wear, with kids’ footwear scaling significant numbers.

Additionally, FirstCry, established in 2010, has become India’s largest online store for newborn, baby, and kids’ products.

Offline retailers are equally contributing to this growth. Brands like Pantaloons and Shoppers Stop have dedicated sections for kids’ apparel, providing a variety of options for parents seeking quality and fashionable clothing for their children.

In response to the growing demand for child-specific personal care products, companies are expanding their offerings.

For instance, Dabur India has ventured into the kids’ toothpaste segment, addressing the need for child-specific oral care.

Similarly, DOMS India has strategically acquired the baby hygiene brand Uniclan Healthcare, marking its entry into the baby care market.

Furthermore, startups like Yellow Naturals, co-founded by Pooja Dugar and Alok Nagpal, specialize in natural personal care and skincare products for children aged 4-12, catering to health-conscious parents seeking organic, chemical-free options.

As parents increasingly move away from processed junk food, there is a rising demand for organic, sugar-free, and fortified nutrition options for children.

In response to the growing demand for healthier snack options for children, several Indian brands have emerged, focusing on organic, sugar-free, and nutrient-rich products.

For instance, Slurrp Farm, founded by two mothers, offers a variety of snacks made from wholesome ingredients like millets and oats, ensuring their products are free from preservatives and artificial flavors.

Similarly, Timios, co-founded by Hima Bindu and her brother, provides a range of healthy snacks tailored for children, including cereals, energy bars, and puffs, all made with natural ingredients and devoid of artificial additives.

Another notable brand is Snack-A-Doodle, a Mumbai-based company that offers gluten-free and processed sugar-free snacks, ensuring that children receive tasty yet healthy alternatives to traditional junk food.

These brands exemplify the broader trend towards health-conscious consumption, innovating to meet the nutritional needs of children while ensuring their products are both appealing and wholesome.

This shift reflects a broader trend towards health-conscious consumption, with companies innovating to meet the nutritional needs of children while ensuring their products are both appealing and wholesome.

Collectively, these developments across various sectors underscore the dynamic growth of India’s kids’ consumer market, driven by evolving parental preferences and a heightened focus on quality and safety.

As India’s kids’ consumer market grows rapidly, businesses face a unique set of challenges and opportunities.

While demand is soaring, companies must navigate stiff competition, regulatory hurdles, and affordability concerns.

At the same time, expansion into Tier 2 & Tier 3 cities, the rise of homegrown brands, and innovative subscription-based models present exciting growth opportunities.

The Indian market is increasingly dominated by international brands in categories such as kids’ fashion, toys, and personal care.

Established global brands like H&M Kids, Mothercare, Chicco, LEGO, and Disney Baby have significant brand recognition and customer trust.

They attract urban, premium-segment consumers who are willing to pay for high-quality, safety-certified products.

Competing with these brands poses a challenge for local startups and mid-range companies, especially when it comes to maintaining quality standards while keeping prices competitive.

Indian parents today seek high-quality and safe products but are also price-sensitive. While premium brands appeal to upper-middle-class consumers, a large portion of the Indian market looks for affordable alternatives.

For instance, a wooden STEM toy from a premium brand may cost ₹2,000–₹3,000, whereas local alternatives with slightly lower durability may sell for ₹800–₹1,500.

Brands must strike a balance by offering value-for-money products while maintaining safety and innovation.

Startups often struggle to scale operations while keeping their pricing accessible, especially in price-sensitive categories like kids’ apparel, hygiene, and toys.

As the kids’ segment involves sensitive consumer groups (infants and young children), strict safety guidelines apply across various categories.

Navigating these regulatory requirements adds to manufacturing costs, production timelines, and compliance burdens, particularly for small businesses.

Historically, kids’ premium product sales were concentrated in metro cities like Mumbai, Delhi, and Bangalore.

However, with rising disposable incomes in Tier 2 & Tier 3 cities, there is massive untapped potential. Brands are expanding beyond metros to cater to aspirational parents who demand quality but seek affordability.

Retail giants like Reliance Trends, Pantaloons, and FirstCry are opening more stores in smaller cities, creating access to branded kids’ products for a wider audience.

Indian startups are disrupting the kids’ market, offering innovative, India-specific products at competitive prices.

Skillmatics, for example, is an educational toy brand that competes with LEGO and international STEM toy brands, but at a more accessible price point. Includ is making a mark in the kids’ apparel space, while Green Gold capitalizes on homegrown animated IPs like Chhota Bheem, creating a strong merchandise market around Indian content.

With local expertise and culturally relevant offerings, these brands are carving a niche in the domestic market.

A new wave of subscription-based services is transforming the kids’ consumer space. Parents are increasingly opting for:

These models reduce costs for parents, promote sustainability, and build long-term customer loyalty for brands.

While competition, affordability constraints, and regulatory compliance pose hurdles, the expansion of retail beyond metros, the rise of local brands, and the shift towards subscription-based convenience offer immense growth potential.

As Indian parents continue to prioritize quality, safety, and innovation, brands that can blend affordability with premium offerings while leveraging digital-first and experiential models are poised to thrive in this dynamic market.

The kids’ consumer market in India is undergoing a significant transformation, driven by technological advancements, sustainability initiatives, and innovative marketing strategies.

Artificial Intelligence (AI) is revolutionizing the way children’s products are designed and delivered. Platforms like ‘Boost My Child’, launched in Pune, utilize AI to offer personalized learning experiences tailored to individual needs, enhancing early education.

Additionally, AI-powered educational tools are providing customized content, adapting to each child’s learning pace and style, thereby fostering a more engaging and effective learning environment.

There is a growing demand for sustainable and eco-friendly baby products among Indian parents. Brands are responding by offering items such as organic cotton clothing and biodegradable diapers. This shift reflects a broader consumer trend towards environmental consciousness, with companies innovating to meet the needs of eco-aware parents.

In the digital age, influencer marketing has become a pivotal strategy for brands targeting young parents. Companies are leveraging social media platforms to engage with consumers, often collaborating with influencers to build brand credibility and drive sales. This approach allows for direct interaction with the target audience, fostering trust and brand loyalty.

The kids’ consumer market in India is evolving rapidly, presenting substantial opportunities for brands and investors.

As e-commerce continues to expand and parents become more discerning about quality, the sector is poised for remarkable growth in the coming years.

Embracing technological innovations, sustainable practices, and digital engagement will be Companies that embrace technology, sustainability, and digital engagement will stay ahead in this dynamic landscape.

At Technopak Advisors, we help businesses navigate the evolving retail sector, including the growing kids’ market.

To explore strategic insights and tailored solutions, connect with us.